In recent updates we’ve discussed the recoveries from 09-May’s lows as rendering the late-Apr/early-May setbacks as corrective within the secular bull trends in Jul and Dec corn. And the Dec contract did reach a new contract high on Mon. But the past couple days’ short-term momentum failures in both contracts, and especially in the Jul contract, threaten more immediate bullish counts and cannot be ignored as early evidence of resurrected peak/correction/reversal threats that, given historic bullish sentiment, could morph into more protracted corrections or reversals lower.

JUL CORN

On the heels of Mon’s bullish divergence in short-term momentum, yesterday’s failure to sustain those early-week gains above 13-May’s 7.77 low renders the recovery attempt from 09-May’s 7.69 low to Mon’s 8.10 high a 3-wave affair as labeled in the hourly chart below. Left unaltered by a recovery above 8.10, this 3-wave bounce is considered a corrective/consolidative (B- or 2nd-Wave) corrective retest of 29-Apr’s 8.25 high within a larger-degree correction or possible reversal lower that warns of a break below 09-May’s 7.69 low. And once below 7.69, there will be no way to know if the resumed slide from 8.10 is the completing C-Wave of a broader bull market correction or the dramatic 3rd-Wave of the start of a more protracted reversal lower. Per such, the market has defined 8.10 and 8.25 as our new mini and short-term risk parameters from which non-bullish decisions like long-covers, bearish punts and initial bear hedges can be objectively based and managed.

From a longer-term perspective, the magnitude of the secular bull trend prohibits us from concluding its end from this month’s piddly erosion thus far. Indeed, commensurately larger-degree weakness below AT LEAST former 7.45-area resistance-turned-support from Mar remains minimally required to threaten the secular bull trend sufficiently for long-term commercial players to considered neutralizing long-term bullish exposure and flipping the script to a new bearish policy. Even a break below 09-May’s 7.69 low would remain well within the bounds of a mere (4th-Wave) correction within the secular bull market. Per such, technical and trading SCALE must be considered in continuing to navigate this common correction-vs-reversal debate and challenge. What we CAN conclude with specificity are the levels like 8.10 and obviously 8.25 that the market would subsequently have to recover above to confirm this month’s price action as corrective and re-expose the secular bull. Per such, longer-term commercial players have the option of either maintaining a bullish policy until/unless the market fails below at least 7.45 and/or acknowledging and accepting whipsaw risk back above 8.10 or 8.25 in exchange for deeper nominal risk below 7.45.

Integral to any peak/reversal-threat process are the understandably historically-skewed bullish sentiment/contrary opinion levels that such a mega-bull evoke. Such frothy levels are typical of major PEAK/reversal environments and we have no doubt whatsoever that, just like 2012’s massive peak/reversal, this indicator will warn of and accompany another major top in this market and expose another multi-quarter or multi-year bear market. This said, it’s also worth keeping in mind however that our RJO Bullish Sentiment Index of the hot Managed Money positions reportable to the CFTC has been in a frothy 84%-to-98%-range for the past 17 MONTHS while the secular bull trend exploded 83% from around 4.50 to 8.25. To use or rely on this valuable technical tool to CONCLUDE a major top after such piddly weakness thus far this month would be premature at best. Nonetheless, we take confidence in the market’s defined levels at 8.10 and 8.25 as objective risk parameters from which to put down an early, conservative bet on the prospect for a more protracted reversal lower.

These issues considered, traders are advised to pare or neutralize bullish exposure and even consider cautious bearish exposure from current 7.75-area levels OB with a recovery above 8.10 required to threaten this count enough to warrant its cover. Longer-term commercial players remain advised to maintain a bullish policy until negated by a relapse below 7.45. Longer-term players also have the option of paring or neutralizing bullish exposure around current 7.75-area levels and acknowledging and accept whipsaw risk, back above 8.10, in exchange for steeper nominal risk below 7.45.

DEC CORN

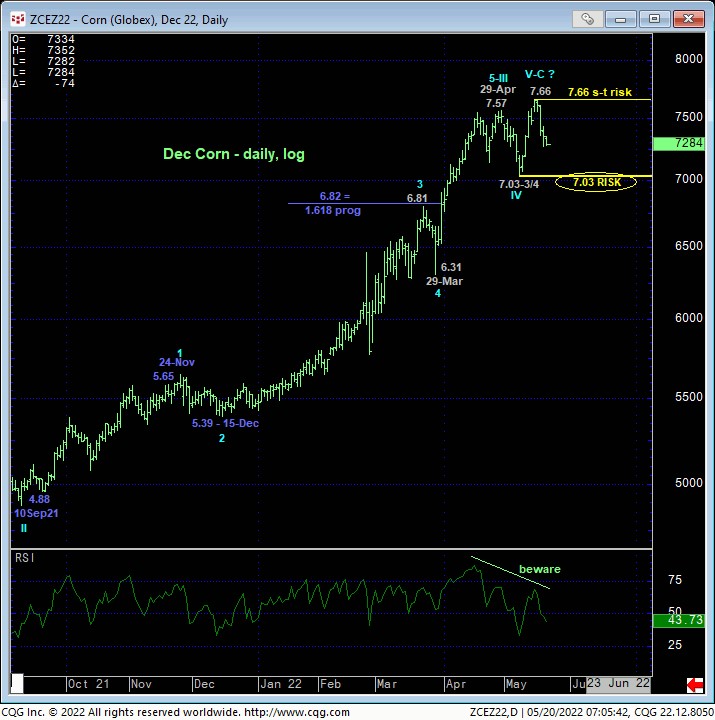

After posting a new al-time high Mon above 29-Apr’s 7.57 high, the Dec contract’s failure below 13-May’s 7.45 minor corrective low confirms a bearish divergence in short-term momentum. This defines Mon’s 7.66 high as the end of the rally from 09-May’s 7.03 low. And per such, this 7.66 high is considered our new short-term risk parameter from which shorter-term traders with tighter risk profiles can objectively manage non-bullish decisions like long-covers and cautious bullish punts.

From a longer-term perspective, this week’s bearish divergence in short-term momentum is of a grossly INsufficient scale to conclude anything more than another interim corrective hiccup within the secular bull trend. Commensurately larger-degree weakness below 09-May’s 7.03 larger-degree corrective low remains MINIMALLY required to confirm a bearish divergence in momentum of a scale sufficient to threaten the major bull and satisfy even the first of our three key reversal requirements. Thereafter and assuming trendy, impulsive behavior on the assumed A- or 1st-Wave initial counter-trend decline, the market would be required to prove 3-wave corrective behavior on a subsequent rebuttal to that initial decline to satisfy the key third of our three reversal requirements.

The long-term forces that have driven this secular bull aren’t likely to evaporate quickly, but rather in a peak/reversal PROCESS that takes TIME and typically includes an initial counter-trend break and an often times extensive (B- or 2nd-wave) corrective recovery before the major (C- or 3rd-wave) reversal damage and opportunity takes place. A failure below 7.03 remains minimally require to even expose the possibility of a major peak/reversal-threat environment on a scale pertinent to longer-term commercial players.

These issues considered, shorter-term traders have been advised to move to a neutral-to-cautiously-bearish stance with a recovery above 7.66 negating this call, warranting its cover and reinstating the secular bull. Longer-term players remain advised to maintain a bullish policy and exposure with a failure below 7.03 require to threaten this count enough to warrant moving to a neutral/sideline/hedged position. For those interested in a pre-emptive bearish strike, this is quite OK. The risk of doing so is precisely to 7.66.