Much of the frost news has been mitigated by the reality that the damage done was not as bad as traders had earlier anticipated. The Hightower Group has reported that “Brazil’s largest co-op Cooxupe reported little impact from the freezing temperatures over the weekend. Most of Cooxupe’s growing areas are in the state of Minas Gerais, which could indicate that the key Arabica growing areas in that region have escaped with little to no frost damage.” In addition, it actually looks as though favorable weather is on the horizon for key growing areas of Brazil, which could add additional pressure to September coffee prices.

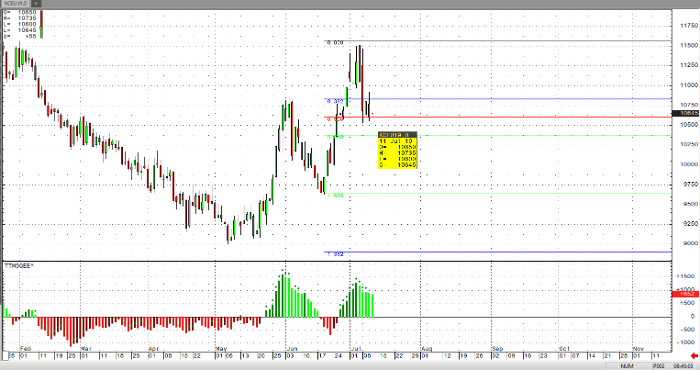

From a technical perspective, it would seem this recent steep selloff in September coffee prices could be nothing more than a strong corrective pullback, allowing the bulls to take profits and re-enter from the long side. We’ve seen the recent selloff in September prices retrace approximately 60% from the last major rally (measured from the June lows to the July 5th high of 11565. September coffee prices have also retraced violate the last major rally high (10860) and are currently trading below this area. This area should have held strong support. Although we are trading below this area, the consolidation of price action may suggest a re-grouping of the bulls at this level. Until a major threat of the large supplies are realistically threatened, I remain neutral on September coffee prices and would expect some support to be held here at the 106 level in the near term.

Coffee Sep ’19 Daily Chart