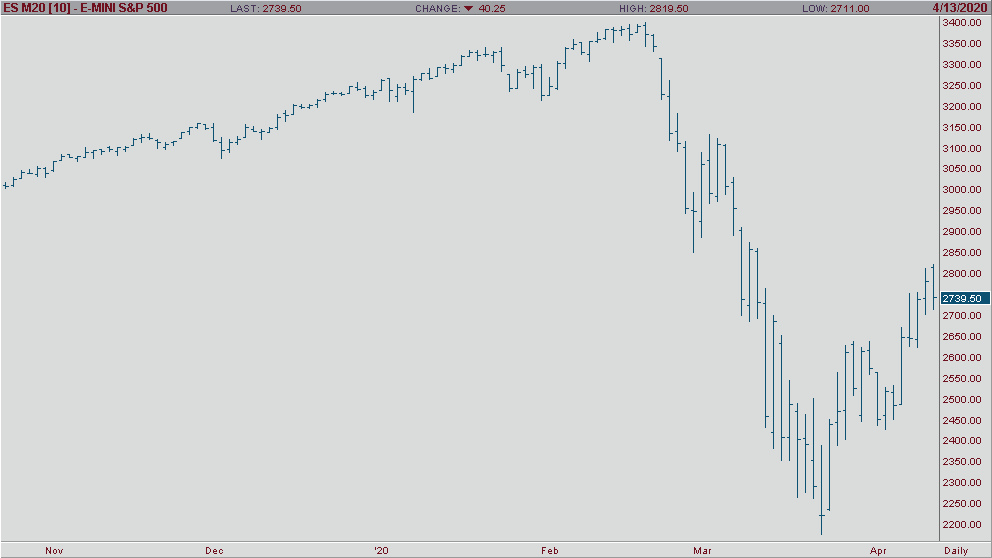

After the S&P 500 boasted its largest weekly percentage increase since 1974 last week, stocks fell early Monday morning. Perhaps prefacing what’s to come as we begin corporate earnings season. At the time of this writing, we are seeing the SP 500 down 1.96%, Dow down 2.09% and the Nasdaq down .91%. However, despite this morning’s negativity, many experts are still bullish on stocks going forward. On a positive note, crude oil jumped a bit this morning after President Trump tweeted that OPEC and oil output cuts would be double the number many were expecting. The President also tweeted out about the possible reopening of the U.S. economy saying that a decision will be made shortly.

On the coronavirus front, we saw some small, but encouraging numbers as infection rate declined for a second straight day to 5.4% on Sunday. A nice jump from the 7.4% we saw on Friday. New York, the current epicenter for the virus in the U.S. saw a sixth straight day of the death toll climbing above 700, however the number for deaths on Sunday (758) was down for the third straight day. Experts are beginning to believe that New York is starting to plateau, which is encouraging news, but in no way, shape, or form means we are out of the woods yet. Dr. Anthony Fauci said that we could potentially see some loosening of social distancing rules in certain parts of the country within the next month or so but doesn’t know for sure. Fauci admitted that this will not be a “lightswitch” scenario where suddenly life goes back to normal. This will be a gradual climb. Until then, stay safe and stay healthy.