Stocks rallied on the open this morning after the June job data showed an accelerating recovery for the U.S. labor market. According to the Bureau of Labor Statistics, the economy added 850,000 jobs last month. Economist estimated and addition of 706,000. This topped the 559,000 that were created in May. However, the unemployment number came in a little higher than expected at 5.9%. According to James McCann, an economist ant Aberdeen Standard Investments. “This is a strong report and should be taken as a sign of things to come for an accelerating labor market. Today’s data won’t change the Fed’s view. An acceleration in the labor market like the one signaled in this report is exactly what they were anticipating,” McCann added. “The pick-up in hiring should tell the central bank that firms are having more success finding workers, which will ease concerns about a more protracted period of increasing wages. What will happen now is that investors will really focus in on when the Fed is likely to announce a tapering of its asset purchases.”

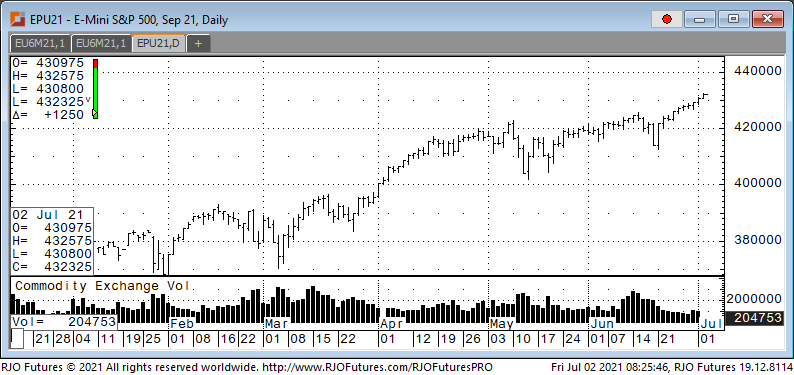

Support today is showing 429000 and 427800 with resistance being 432100 and 433000.