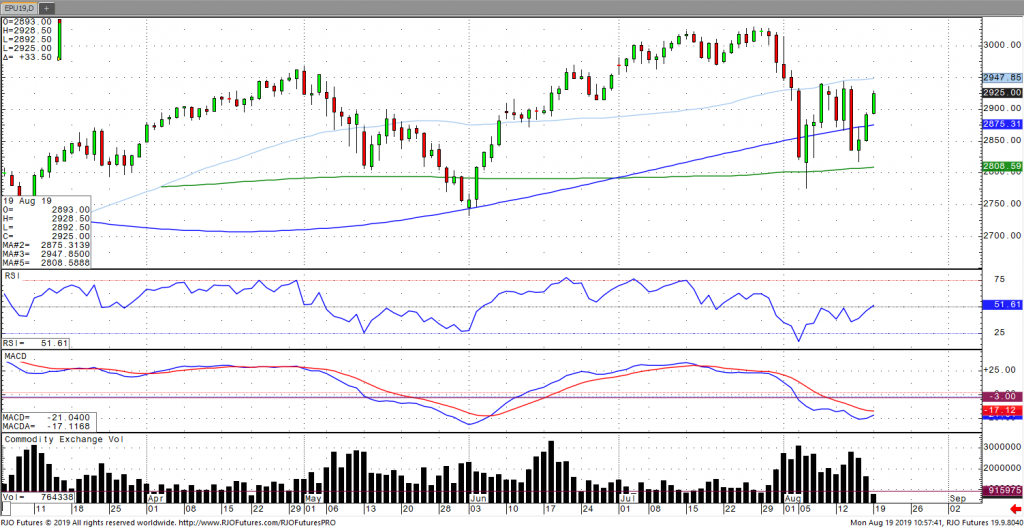

U.S. stocks have followed Asian markets higher in the early session with the Hang Seng and the Shanghai composite up 2.2%, while the Japanese and Korea indexes rose less than 1% apiece. This comes amidst reports of Beijing intending to reform its interest rate system and cut borrowing costs in addition to speculation regarding European Bank and German fiscal stimulus. The market will be looking ahead to the Jackson Hole symposium with Fed Chairman Powell set to speak on Friday, in addition to the latest FOMC minutes set to be released Wednesday as well as host of global PMI’s will be assessed. Strong overhead resistance for the Sept S&P500 comes in around 2931 with the market remaining bearish trend and today’s range seen between 2826 – 2927.