U.S. stock futures quickly rallied off their lows this morning after a release of a Federal Reserve inflation gauge that calmed some worries of the rising interest rate. The Fed released their personal consumption index expenditures price index, PCE, showing an increase of 0.3% for the month which was slightly ahead of the expected 0.2%. Conversely, yields on treasuries dropped after this release. The 10- year slipped close to 5 basis points to 1.47% after seeing a high above 1.6% on Thursday. The 10-year, a bond rate used as a benchmark for auto and mortgage loans, is up a surprising 50 basis points since the beginning of the year. Traders will also be looking at Congress today as the Democratic-controlled U.S. House of Representatives looks to pass President Biden’s $1.9 trillion coronavirus aid bill. This would be his first major legislative victory of his presidency.

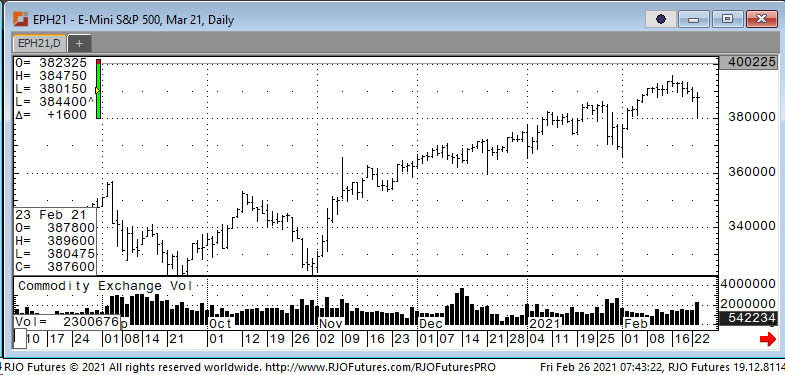

Support today is 376000 and 37200 with resistance checking in at 389000 and 3980000.