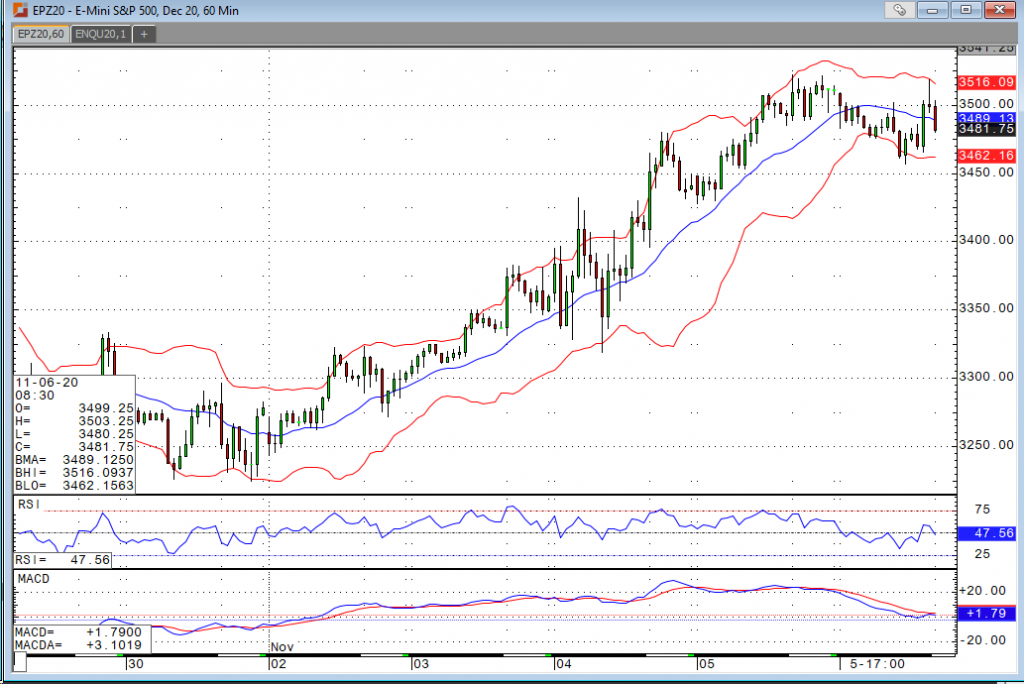

Despite all the election uncertainty, stocks have been on an impressive run. President Trump’s odds for a victory seem to be diminishing by the minute, but we’ll see how long this takes to play out in the courts. It does appear that the GOP will hold the senate and the market seems to be happy with the idea of that. Stocks were lower overnight, but the non-farm payroll data boosted the markets at least temporarily. The labor market added 638,000 jobs (575,000 consensus), and the unemployment rate came in at 6.9% (7.7% consensus). The rally was short-lived, and we’re well into negative territory to kick things off today. We’re overbought technically, and I can’t blame investors for wanting to book some profits ahead of the weekend. The trend is strong to the upside, we’ve seen nice rallies into the end of year holidays in the recent past, so now the question is how low will we be able to get back in?.