Rising interest rates and inflation fears have rocked the equity markets this week. The tick up in interest rates led to rumors of another “Operation Twist” policy being in the works. The process involves the Fed selling shorter term treasuries and buying longer dated ones. The goal is to encourage growth by lowering longer term rates. When Jerome Powell expressed that he had little concern over inflation fears during his speech yesterday, the market collapsed.

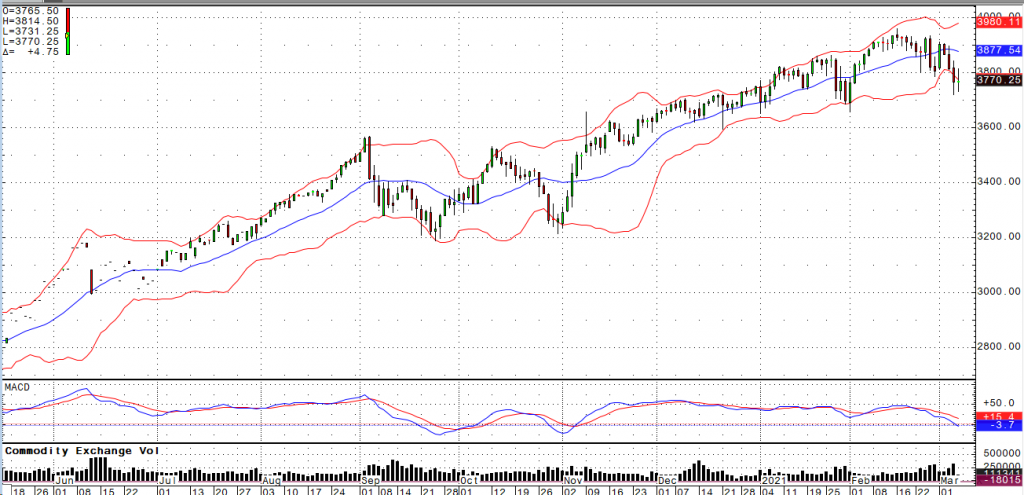

Yesterday’s dip eventually got bought in to the close, but markets struggled to build on the late momentum, resulting in choppy trade overnight. When the jobs data was released showing a gain of 379k jobs (175k expected) and an unemployment rate of 6.2%, a quick selloff was followed by a sharp rally. Since then, we’ve seen a bit of a mixed bag with higher dollar and higher yields continuing to weigh on the Nasdaq in particular. The dollar hit our initial target of 92.00 overnight (92.225 high) and has since backed off a bit. We still think that 92.70 might be in the cards, but we should find some real issues overcoming 94.00. With that in mind, I think we may see some even lower prices in equities (targeting 3685 and 12000-12200 in the S&P and Nasdaq, respectively) before we are likely to see another rally.