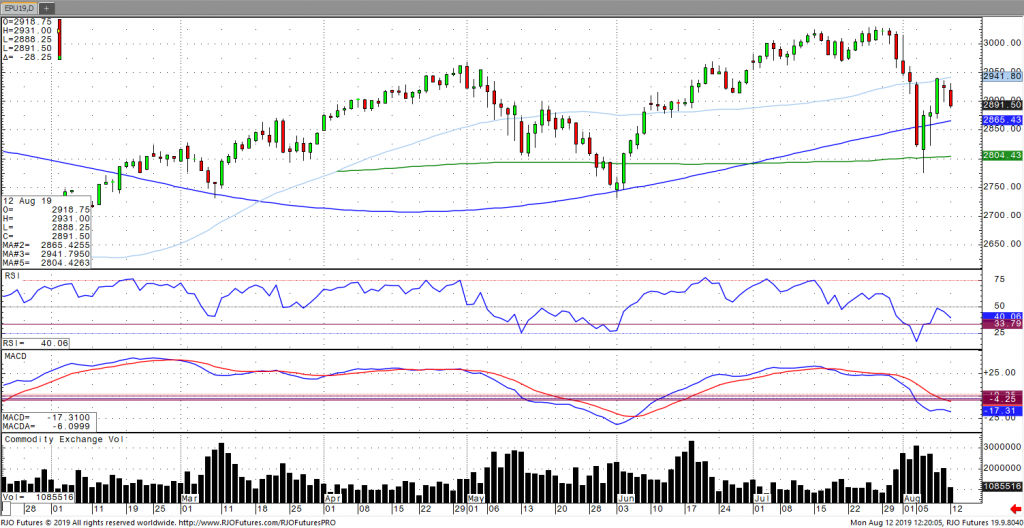

Global equity markets were largely mixed in the overnight with Shanghai Composite closing higher with China’s central bank continuing to devalue to the yuan and the Hang Seng down 0.5% following ongoing violence and further protests in the city’s airport. Coupled with the ongoing deceleration in local and global growth as well as the intensifying U.S. – China trade conflict, the market will be looking ahead to Q2 German GDP as well US CPI data, which will provide another opportunity to assess Fed expectations with consensus expecting further easing. The S&P 500 remains bearish trend with today’s range seen between 2824 – 2949 with near term support seen around 2880.