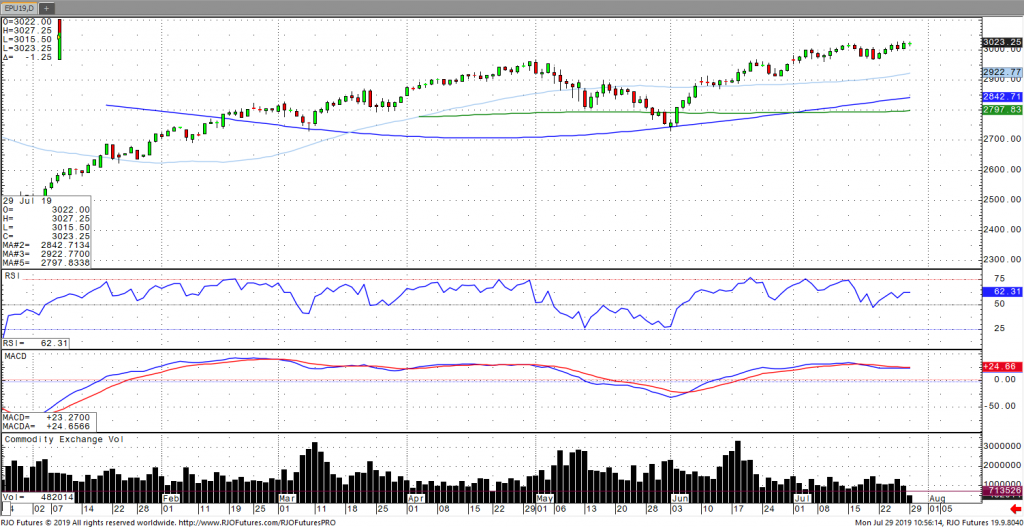

The U.S. equity markets are mixed in the early session following further weakness in Asia with the KOSPI leading, down – 1.7%, Hang Seng down -1.0% and India down -5.1% in the last month after breaking down from bullish to bearish trend in early July. This comes amidst a widely expected (and priced in) rate cut from the US Federal Reserve, the first since 2008, coupled with announcements from the BOE and the BOJ. In addition, a slew of economic data is set to be released including the U.S. monthly jobs report, Q2 Eurozone GDP and PMIs as well as a continuation of ongoing U.S.-China trade talks and further release of earnings with over 150 S&P 500 companies set to report. The upward bias remains in the S&P with the recent pattern of higher highs and higher lows but may consolidate prior to the Fed with support coming in at 3000 and the next upside target around 3035. The S&P500 remains bullish trend with today’s range seen between 2968 – 3033.