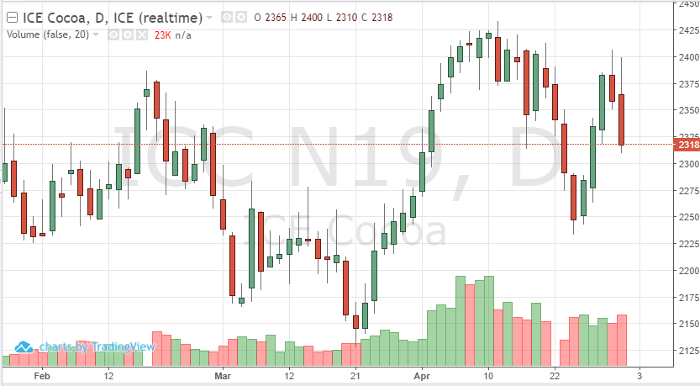

July cocoa futures’ prices have been unable to hold above 2425. After reaching the high in April on the 11th, the market slowly crept down to the 2250 area. Although we had strong demand news on grinding data and the market had also found support in production levels; profit taking and fund selling pressured the market and ended the month with some volatility. The euro and pound provided support for the longs in the market – that was also not enough to push prices higher. Heat and dry weather from key growing regions is also in the forecast, another signal to stay long the market. With all these signs, a close below the 9-day moving average is a short-term negative indicator. A close above the 200-day moving average is a positive indicator in the long-term though, which is part of the reason we are seeing bigger swings over the last few trading sessions. Technicals have been important for prices. There has been support at 2300, 2315. Resistance is strong at 2360 and 2375. Monitor COT data, demand news and short-term production levels – but in the near trade, longs liquidating, and profit targets being hit has lead the trade.

Cocoa Jul ’19 Daily Chart