Currency futures were in complete fluctuation this week, as the Federal Reserve cut the benchmark interest rate for the first time since 2008. We observed huge levels of volatility as the markets searched for direction during a historic week for monetary policy. A 25-bps rate cut was largely priced into markets, but the rhetoric of Chairman Powell had investors and traders on edge. Given stagnant inflation, weak manufacturing, and global trade tensions, it was no surprise to see the FOMC loosen the belt of monetary policy to stimulate borrowing and business investment. However, markets were hoping the Fed announcement would hint at a lengthy easing cycle with multiple rate cuts in the back half of 2019. But Powell indicated this was a mid-cycle insurance cut, to ensure the continuation of the expansion in the face of growth constraints. Will they cut again? Maybe. In short, the chairman was not dovish enough. Because dovishness weakens the domestic currency, it is no surprise that the dollar surged on the news. The floor fell through all major foreign currencies following the report, but rebounds were observed since Wednesday.

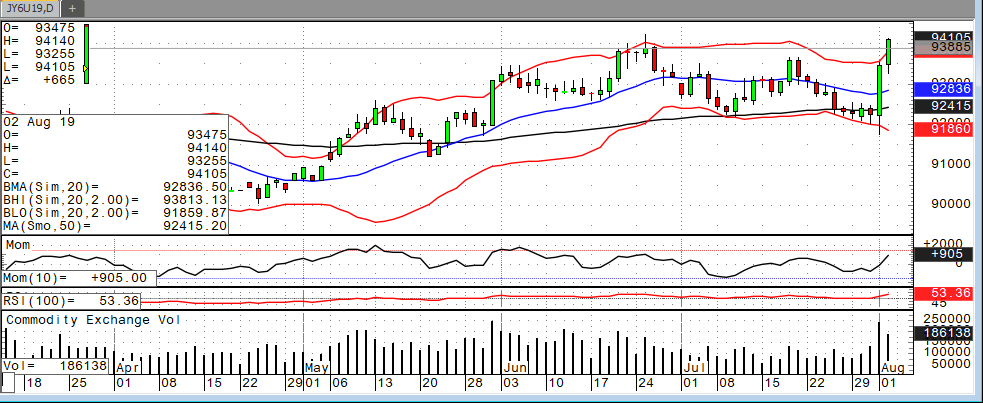

Following Trump’s announcement on Thursday regarding additional tariffs on Chinese imports, the USD came well off its weekly highs and safe-haven currencies had all the room to run. The Japanese yen is trading back near contract highs, with the Swiss franc following suit. Commodity currencies were the true losers this week. The Aussie and the Canadian dollar plunged. The euro and the pound deepened bear tracks, especially given Mario Draghi’s dovish rhetoric at the ECB meeting last week. Bulls are only eyeing safe-haven currencies, as fears of a global currency war are looming, and the greenback may lose its place as the reserve currency of the world.