U.S. government bond yields have rebounded off Tuesday’s close below 2% on reinvigorated hopes of a potential trade agreement ahead of a scheduled meeting between President Trump and Chinese President Xi at the upcoming G-20 summit in Japan. Tuesday’s close below 2% on the benchmark ten-year note followed comments by the Fed President of St Louis stating that a 50-basis point cut is not warranted, and comments by Chairman Powell that the central bank is “mindful that monetary policy should not overreact to any individual data point or short-term swing in sentiment.” Yields have fallen in recent weeks in anticipation of lower interest rates but have edged higher today on a plunge in U.S. Durable Goods Orders with a 3.3% decline on a YoY basis, the most since July 2016. Near term resistance for Sept bonds comes in around the 156-00 handle at the double high with the yield on the ten-year note remaining bearish trend with today’s range seen between 1.98 -2.13.

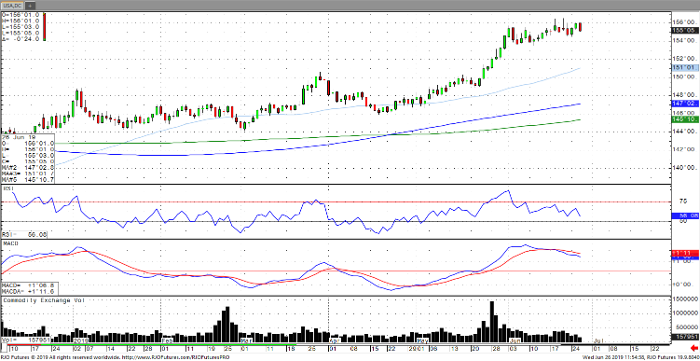

30-Year Bond Sep ’19 Daily Chart