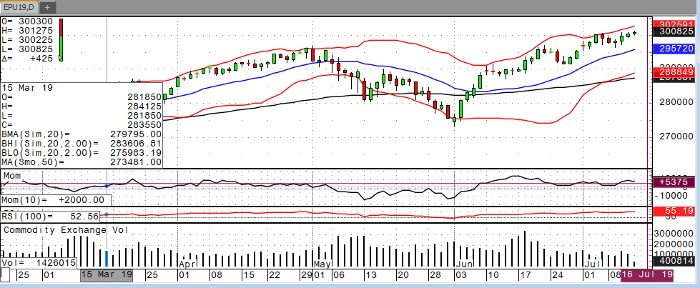

Global equity markets were mixed overnight, while the Sep S&P pushed through resistance at 3006 to another all-time high. This week’s move higher comes on the heels of Chairman Powell’s testimony, which reassured market beliefs that a rate cut will occur at the July FOMC meeting. Why? Inflation lingers below the Fed’s 2% target. Manufacturing data around the world is lagging. The probability of recession occurring within the next 12 months has moved past 30%, and developed economies are reallocating funds into safe-haven assets… not to mention the need to counter a U.S. deficit through dollar injection. Economic warning signs are flashing, and Powell is prepared to use the tools of the Federal Reserve (i.e. rate cuts) to continue this expansion. The disconnect between the U.S. stock market and foreign indices is clear. U.S. equities push into all-time highs while Chinese and European shares are selling off. This tells me that foreign investors are flocking to lower-risk U.S. markets. I believe markets have a bit more upside into next week, when the corporate earnings carpet really rolls out. What are we expecting? I believe Q2 earnings will be weak compared to last year, given that 2017 tax cuts created accelerated growth into 2018. It does not seem plausible for growth to continue accelerating given the effects of Chinese tariffs and slowing economic growth. This earnings season could be the catalyst the market needs to sell-off. The most recent rally was fueled by defensive stocks, with utility ETFs lighting the path to fresh highs. Tech stocks, which led the decade-long bull market, have the most exposure to a sell-off. Apple stock – often viewed as a general market indicator – has been downgraded to a sell by several small houses. Will investors continue to pile into a saturated stock market in the face of global warning signs? One this is clear, institutions are diversifying to hedge downside risk in stocks.

E-Mini S&P 500 Sep ’19 Daily Chart