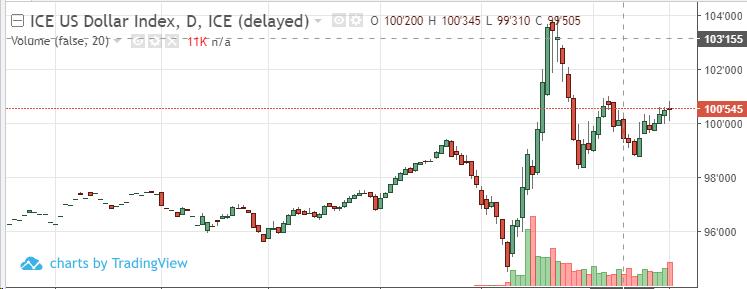

Currency futures are mixed during Thursday’s trade as the U.S. dollar index is essentially flat on the day after trading in a 73-point intraday range. Short-term traders should look for a stronger dollar as uncertainty remains high. European fiat futures are likely to continue trending lower. In particular, the technical setup on the euro chart points to a retest of the low at 1.0671. The Australian dollar is also entrenched in a bear trend, trading at the top of its range on Thursday afternoon. Furthermore, the Australian economy is on track to enter its first recession in decades. Commodity currencies, like the Canadian and Australian dollar, typically trend higher went sentiment prefers the “risk on” trade. Therefore, in the likely event that “risk off” sentiment returns to markets, these currencies should be the worst performers. In the longer-term, this trend reverses. The Fed’s “do whatever it takes” attitude will inevitably break the USD and cause reversals in foreign fiat futures. When coronavirus uncertainty subsides, inflation is likely to return to the U.S. economy, and emerging market currencies should outperform those of developed economies.