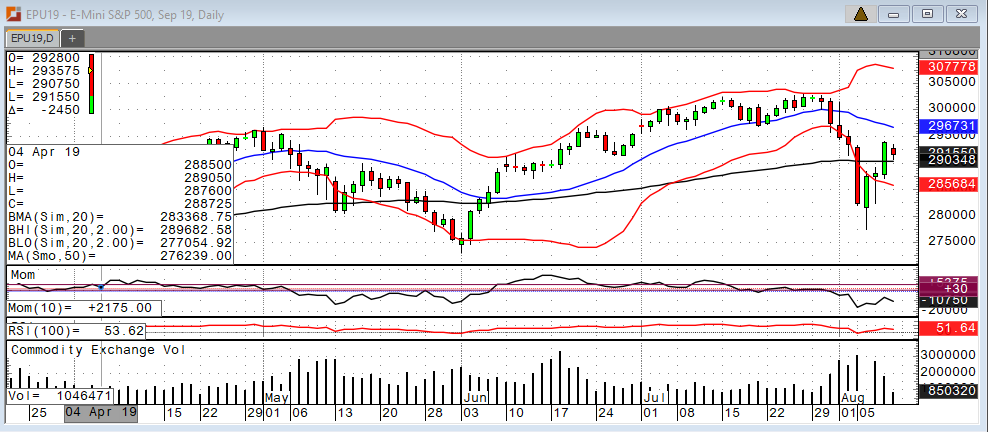

The stock market had investors on their toes this week as it can be summed up with one word: volatile. The VIX indicator reached 24.80 this week and investors saw markets fight for direction in a financial tug-of-war. The initial catalyst for the recent correction was a Fed testimony that the markets viewed as “not dovish enough”, as Powell indicated it was an insurance cut to maintain the historical economic expansion. The real knife to the heart came last Thursday when Donald Trump implemented a fresh round of 10% tariffs on the remaining $300 billion of Chinese imports. Before the news, stock markets were attempting a rebound, which failed almost instantly when the president’s tweet went live. Markets fell through the floor and selling continued into last weekend, then early this week stocks came crashing down.

The Sep S&P plummeted over 100 points on Monday, marking the largest one day sell-off of 2019. The overnight low touched 2775.75, nearly 10% off the all-time high from late July. After such extensive sell-offs, it is not unusual to see a rebound attempt, which took shape on Tuesday. It paved the way higher for the remainder of the week. Friday morning, we are seeing the waters calm compared to earlier this week. The rally hit stiff resistance near 2940, falling 1% Friday morning. I believe the rally was supported by increasing odds of a September rate cut in the face of increasing trade tensions. The odds of a 50-bps cut in September hit nearly 30% this week. Short covering provided aid to the rally as well. Should the market hold Thursday’s low at 2870.50, I believe the rally can sustain itself. The rebound attempt seems to be taking a breather today after running up 5% from Tuesday night’s lows. Investors may consider trading the ranges and treading carefully. One tweet could send markets into an uproar.