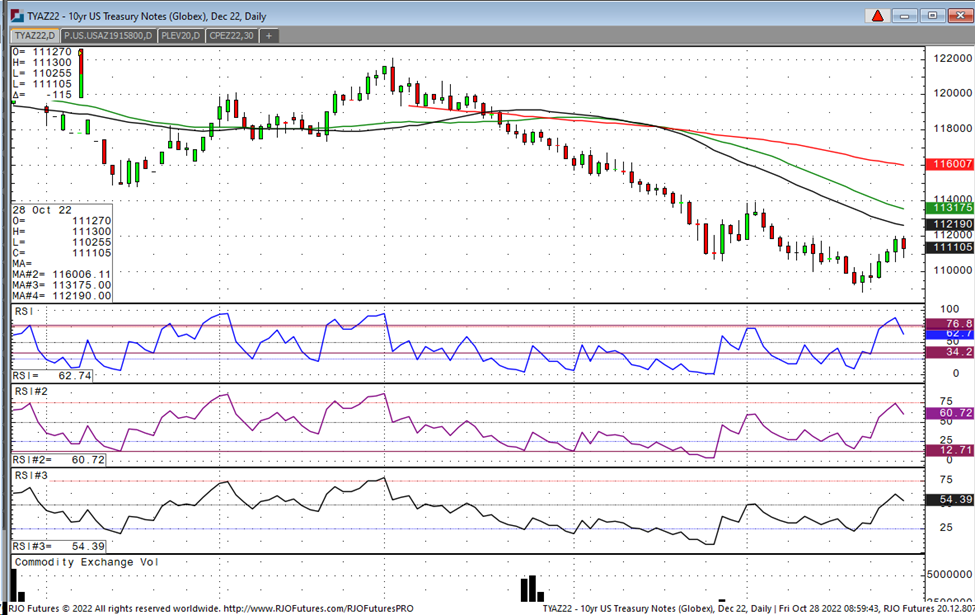

The Dec 10 year note has a had a nice week, making a series of higher lows since Oct 21. The market has taken a beating in the last month though as the Fed is still on pace to raise rates at their upcoming meeting in Dec. The whispers are they will go 75 basis points, but many are suggesting that 50 basis points are in the cards and most importantly, some are even suggesting that the Fed might even say that a pause is possible after the announcement and that has definitely helped many other markets as well including the stocks, and major retreat in the dollar which has led to many to cover short positions in all three markets. Another positive development that treasury market has seen in the last week in weakness in government reports which the Fed is watching closely as the economy slows and weakens, the need for aggressive rate hies has greatly diminished. Traders should keep an eye on the calendar and be watching closely for these reports. In my opinion, we are in a period of bad news is good news, meaning if govt reports continue to show signs of weakness, the change of a Fed pause, or pivot can be in the cards quickly.

DISCLOSURE:

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results.