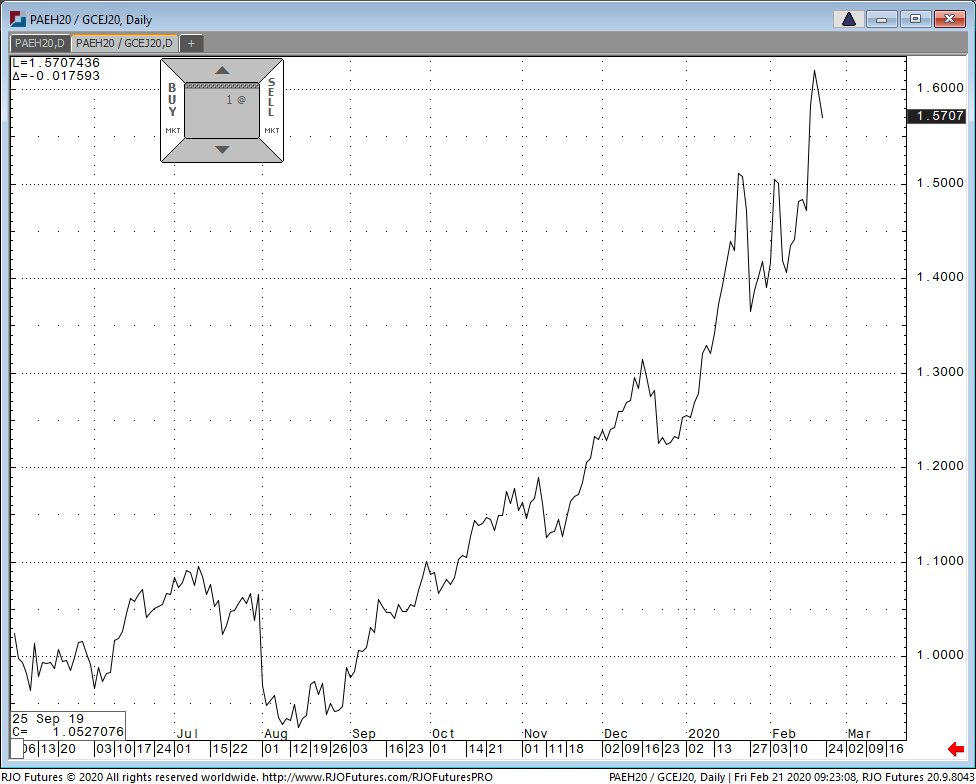

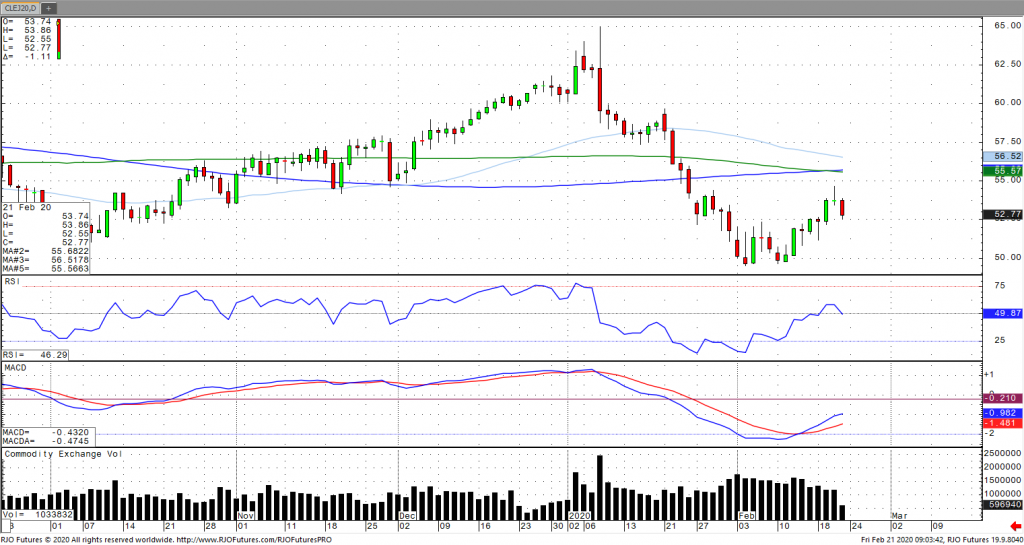

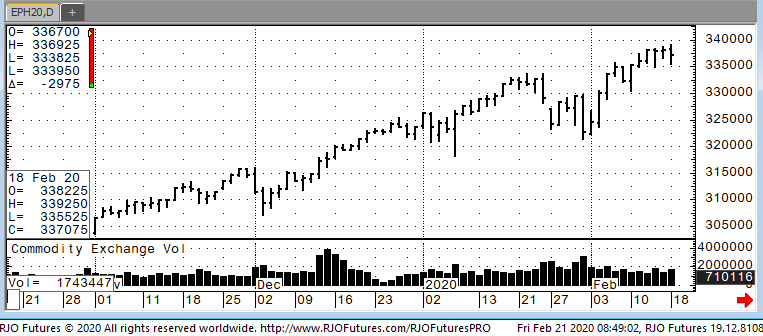

April gold futures have exploded well beyond the spike high we had back in early January with an acceleration of the coronavirus outbreak and news that it is continuing to spread. Traders should be cautious right now with the gold market now in territory we have not seen in 7+ years. This is the time to look at opportunities to utilize options now that volatility premium has increased and possibly trading the shorter term (30 days or less) options. The overall theme supporting gold that is central bank buying and countries such as Russia and China diversifying away from the strong U.S. dollar and buying substantial amounts of physical gold has not gone away. This has been propping up the market along with traders around the world taking note that the stock market seems to be shrugging off the virus and its longer-term impact on company earnings. Today, we see the US equities selling off and gold making an exploding move higher trading as high as $1652 as I write this.

When any market starts making moves like this it captivates people’s attention and the “FOMO” on the trade. Gold is likely to continue its move higher, but only briefly. What could derail this rally is any information that indicates the virus is under control and vaccines are now widely available. Right now, the vast majority of cases are in China, but the impact on the markets longer term is very unknown. I think the Chinese are likely to underreport the economic damage as they’ve done in the past and continue to inject stimulus money (over $400B so far) to keep their economy humming along. Gold is worth taking a shot at regardless, and if you would like to know how best to play the precious metal please contact me directly.