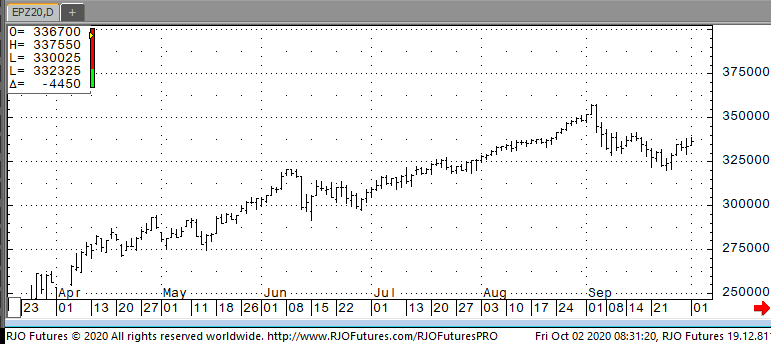

December gold future have been bouncing around in remarkable fashion over the past few weeks. The average range on gold from top to bottom on any given day is $35. That would be $3500 profit or loss on a single futures contract. We have been close to $2000 just a few weeks ago only to come crashing down to $1850 and now are back above $1910. The market fundamentally has lost a bit of steam as the new bullish themes for gold seam to have faded away. The US dollar index is also pressuring the precious metal and has also finally broke out above 94.00 which was what the market was looking for after several months of consolidation sideways. In my view the gold market has been broken down and done too much technical damage to return back above $2000. US equities are down currently and so is gold. Traders should remember the covid crash and the market reaction in gold, aggressively selling off. Should another crash in equities have any different reaction for gold? I wouldn’t bank on it. Technically gold should be coming down to around 1800 for a psychological retest of a level that some traders will see as value while others who have fought the bears throw in the towel and puke the long position. In the short term, the more aggressive the selloff is in equities the more down gold will likely be. Gold needs a close above 1955 to break a down trend with 3 points of touch going back to August 18th. Until this happens, look for gold to continue its choppy ride lower along with equities.