RJO FuturesCast

September 18, 2020 | Volume 14, Issue 38Feature Articles

New: Gold and Silver Investor Kit

Opportunities Exist in the Metals Markets Right Now –

Precious metals like gold and silver seem to be all anybody is talking about these days, and with good reason! Have you ever wanted to get in on these current opportunities in the metals but didn’t know where to start? Our Gold and Silver Investor Kit has you covered. Whether you are experienced or new to trading, our kit will give you the tools to take advantage of the opportunities that exist in the metals markets right now!

RJO Futures PRO Trading Platform

FREE 100k Simulated Trading Account

Experience a trading platform like no other with integrated tools to seamlessly trade and monitor the markets. With a free simulated trading account and personal broker experience, we’ll teach you about futures trading and help you develop a trading strategy.

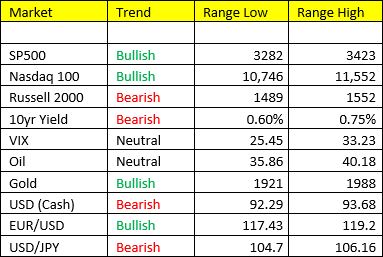

The Markets

Dec silver is trading 27.09 this morning down about a 1 penny. Silver is in my view in a wait and see pattern. The chart below on weekly continuation suggest there may be upside price action in the coming days. The dollar has been weak all morning but it didn’t give much lift to silver. The 28.00 level is a price that is going to be a jump starter for the bull camp. A break above $28 could get silver quickly jumping over $32.00. a roll below $25.00 is needed to discourage the bulls. The best way to approach this market in my view is using options. Please give me call to discuss a specific strategy.

Oil prices are poised for the largest weekly gain since June as a meeting of OPEC+ yesterday urged ‘full conformity and compensating overproduced volumes’ amidst a fleeting recovery in global demand. This comes as Libya is expected to increase production and allow exports to resume as the country is currently pumping just 80k barrels a day while producing 1.2 million a day last year. WTI front month has come back over $41 dollars a barrel buoyed by a softer dollar as well as an unexpected weekly decline in inventories. In addition, Russian Energy Minister noted an expectation of a near full demand recovery by the second quarter of next year. Notwithstanding, recent projections of slowing Chinese demand from June and July add to the already grim outlook for global demand. Oil has now transitioned to neutral trend but look to position with a bearish tilt with today’s range seen between 35.16 – 41.49.

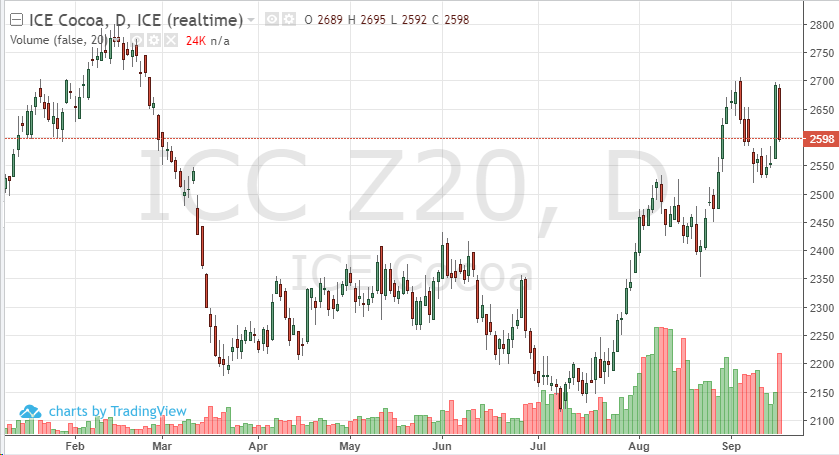

Political unrest in Ivory Coast has added volatility to an already erratic market…. but there is a lot going in cocoa futures. Cameroon reported that their arrivals are lower than last year, they were expected to be higher. Indonesia, the 3rd largest grinding nation of cocoa, reported that exports are ahead of last year’s pace. At the same time, Indonesia’s imports are 23% lower than last year, which adds to the demand issues in the Asian markets. Demand is a concern in the US too due to chocolate company’s anticipation of lower sales due to the “cancellation” of Halloween in many regions.

The Euro and Pound short-term reversals provided support to cocoa prices. Supply is also a concern in key cocoa areas, which is also providing strong support. The macro side of the global markets is also somewhat positive, for now, that is helping some commodities.

Expect the unexpected, as well as volatility, as we trade the next month before the U.S. election. Technically, 2700 is resistance in the December contract, a break and hold above this could have cocoa testing the high put in in February – but the holiday season demand and company earring reports will have control of this market for the remainder of the calendar year.

Posted on Oct 14, 2022, 07:42 by Dave Toth

On the heels of mid-Sep-to-early-Oct's steeper, accelerated, 3rd-wave-looking recovery, the past week-and-a-half's boringly lateral chop is first considered a corrective/consolidative event that warns of a continuation of the uptrend that preceded it to new highs above 04-Oct's 891.0 high. This count remains consistent with our broader base/correction/recovery count introduced in 13-Sep's Technical Blog following that day's bullish divergence in short-term momentum above 07-Sep's 809.5 minor corrective high detailed in the hourly chart below.

The important takeaway from this month's lateral, sleepy price action is the definition of Wed's 851.5 low as the end or lower boundary of a suspected 4th-Wave correction. A failure below 851.5 will confirm a bearish divergence in daily momentum and defer or threaten a bullish count enough to warrant non-bullish decisions like long-covers. A failure below 851.5 will not necessarily negate a broader bullish count, but it will threaten it enough to warrant defensive measures as the next pertinent technical levels below 851.5 are 13-Sep's prospective minor 1st-Wave high at 813.8 and obviously 08-Sep's 766.0 low. And making non-bullish decisions "down there" is sub-optimal to say the least. Per such, both short- and longer-term commercial traders are advised to pare or neutralize bullish exposure on a failure below 851.5, acknowledging and accepting whipsaw risk- back above 04-Oct's 891.0 high- in exchange for much deeper and sub-optimal nominal risk below 766.0.

On a broader scale, the daily log scale chart above shows the developing potential for a bearish divergence in daily momentum that will be considered confirmed below 851.5. This chart also shows the past month's recovery thus far stalling in the immediate neighborhood of the (888.0) Fibonacci minimum 38.2% retrace of Apr-Sep's entire 1128 - 766 decline). COMBINED with a failure below 851.5, traders would then need to be concerned with at least a larger-degree correction pf the past month's rally and possibly a resumption of Apr-Sep's major downtrend.

Until and unless the market fails below 851.5 however, we would remind longer-term players of the key elements on which our bullish count is predicated:

- a confirmed bullish divergence in WEEKLY momentum (below) amidst

- an historically low 11% reading in out RJO Bullish Sentiment Index and

- a textbook complete and major 5-wave Elliott sequence down from 29-Apr's 1128 high to 08-Sep's 766.0 low.

Thus far, the market is only a month into correcting a 4-MONTH, 32% drawdown, so further and possibly protracted gains remain well within the bounds of a major (suspected 2nd-Wave) correction of Apr-Sep's decline within an even more massive PEAK/reversal process from 17-May's 1219 high on an active continuation basis below.

These issues considered, a bullish policy and exposure remain advised with a failure below 851.5 required to defer or threaten this call enough to warrant moving to a neutral/sideline position. In lieu of such weakness, we anticipate a continuation of the past month's rally to new highs and potentially significant gains above 891.0.

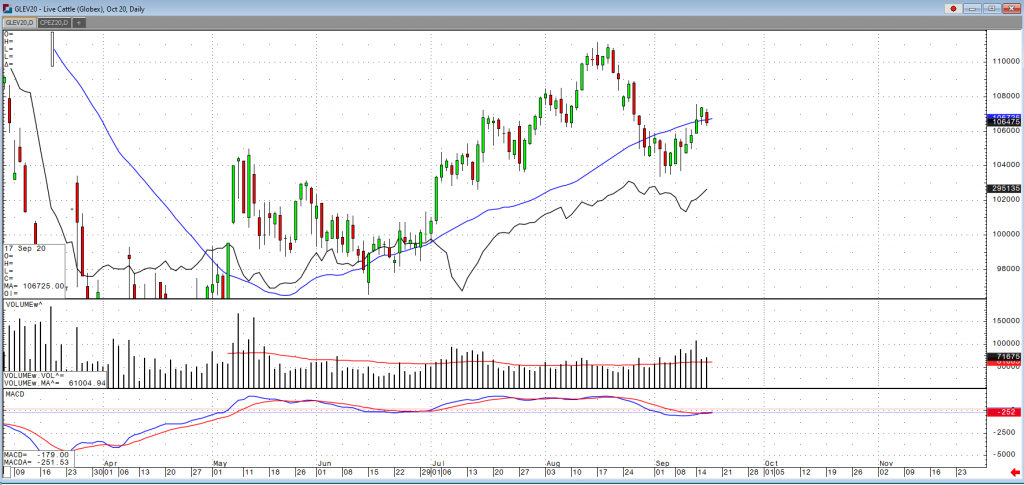

October live cattle rallied a bit yesterday to its August 21st highs as it continues to push towards the August monthly highs of 110. Cash prices continue to trend lower but technical action remains bullish. The market is still bracing for the outlook of production to be increasing in the near term. Cash live cattle are firming up a bit this week. In Kansas on Wednesday, 9,967 head were reported at $100-$103 and an average price of $102.86, up from $101 last week. In Texas/Oklahoma 2,119 head traded at $103-$103.5 and an average price of $103.25, up from $101.81 last week. The USDA estimated cattle slaughter came in at 120,000 head yesterday. This brings the total for the week so far to 360,000 head, up from 241,000 last week, and up from 356,000 a year ago. The USDA boxed beef cutout was down $1.01 at mid-session yesterday and closed 71-cents lower at $215.38. This was down from $222.95 the previous week and was the lowest the cutout had been since August 14. The premium the futures have to the cash market is a little concerning even though we have seen some strong technical price action in the near term. Something to consider would be doing a synthetic strategy of shorting a futures and buying a call option with a delta of 50%.

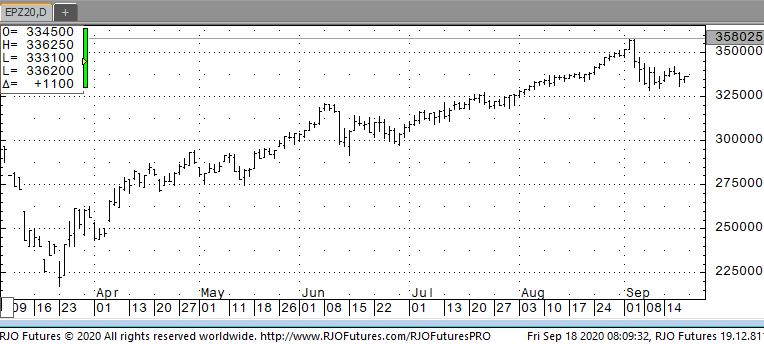

U.S. stocks are looking to open todays session mixed after another volatile day that saw tech stocks fall sharply despite another encouraging jobless number. Facebook, Amazon, and Apple led Thursday’s tumble to the largest down day of the week showing some of the investors concerns as these stocks have been sharply rallying since spring. The U.S. Department of Labor released data on Thursday showing 860,000 claims filed for the week. Even though this was slightly higher than the anticipated number it was still below the psychologically important number of 1 million. On Wednesday the Fed announced it would be keeping interest rates near zero for the better part of three years, this is due to the continuing challenges and risks to the economy from the ongoing pandemic.

Support today is checking in at 331000 and 327500 while resistance is showing 339000 and 342500.

Posted on Nov 08, 2022, 07:51 by Dave Toth

In Fri's Technical Webcast we identified a minor corrective low at 2.6328 from Thur as a mini risk parameter the market needed to sustain gains above to maintain a more immediate bullish count. The 240-min chart below shows the market's failure overnight below this level, confirming a bearish divergence in very short-term momentum. This mo failure defines Fri's 2.8172 high as one of developing importance and a parameter from which very short-term traders can objectively base non-bullish decisions like long-covers.

Given the magnitude of the past three weeks' broader recovery however, this short-term momentum failure is of an insufficient scale to conclude anything more than another correction within this broader recovery from 26-Sep's 2.1877 low. Indeed, overnights failure below 2.6328 only allows us to conclude the end of the portion of the month-and-a-half rally from 31-Oct's 2.4822 next larger-degree corrective low. 2.4822 is the risk parameter this market still needs to fail below to break the uptrend from 18-Oct's 2.3526 low while this 2.3526 low remains intact as the risk parameter this market needs to fail below to break the month-and-a-half uptrend. From an intermediate-to-longer-term perspective, this week's setback falls well within the bounds of another correction ahead of further gains. This is another excellent example of the importance of technical and trading SCALE and understanding and matching directional risk exposure to one's personal risk profile.

The reason overnight's admittedly minor mo failure might have longer-term importance is the 2.8172-area from which it stemmed. In Fri's Technical Blog we also noted the market's engagement of the 2.8076-to-2.8159-area marked by the 61.8% retrace of Jun0-Sewp's 3.2758 -2.1877 decline and the 1.000 progression of Sep-Oct's initial 2.1877 - 2.6185 (suspected a-Wave) rally from 18-Oct's 2.3526 (suspected b-Wave) low. We remind longer-term players that because of the unique and compelling confluence of:

- early-Aug's bearish divergence in WEEKLY momentum amidst

- historically extreme bullish sentiment/contrary opinion levels in our RJO Bullish Sentiment Index

- an arguably complete and massive 5-wave Elliott sequence from Mar'20's 0.4605 low to Jun's 4.3260 high (as labeled in the weekly log active-continuation chart below) and

- the 5-wave impulsive sub-division of Jun-Sep's (suspected initial 1st-Wave) decline

The recovery attempt from 26-Sep's 2.1877 low is arguably only a 3-wave (Wave-2) corrective rebuttal to Jun-Sep's decline within a massive, multi-quarter PEAK/reversal process. Now granted, due to the magnitude of 2020 -2022's secular bull market, we discussed the prospect for this (2nd-Wave corrective) recovery to be "extensive" in terms of both price and time. A "more extensive" correction is typified by a retracement of 61.8% or more and spanning weeks or even months following a 3-month decline. Per such, the (suspected corrective) recovery from 26-Sep's 2.1877 low could easily have further to go, with commensurately larger-degree weakness than that exhibited this week (i.e., a failure below at least 2.4822) required to consider the correction complete. Indeed, the daily log chart above shows the market thus far respecting former 2.6185-area resistance from 10-Oct as a new support candidate.

These issues considered, very shorter-term traders have been advised to move to a neutral/sideline position following overnight's momentum failure below 2.6328, with a recovery above 2.8172 required to negate this call, reaffirm the recovery and re-expose potentially significant gains thereafter. For intermediate- and longer-term players, a bullish policy and exposure remain advised with a failure below 2.4822 required to threaten this call enough to warrant neutralizing exposure. We will be watchful for another bearish divergence in momentum following a recovery attempt that falls short of Fri's 2.8172 high that would be considered the next reinforcing factor to a count calling that 2.8172 high the prospective end to the month-and-a-half 2nd-Wave correction. In lieu of such, a resumption of the current rally to eventual new highs above 2.8172 should not surprise.

I can’t stress the importance of U.S. dollar right here, right now. The dollar has been signaling “higher lows” in the model, which may suggest a regime change in broader asset classes. We’re coming off of a cycle in which we were BULLISH on commodity assets, BULLISH on tech, BULLISH on foreign currency, BEARISH on the USD. This could all change if the USD reverses it’s 3 month decline in Q4. Did you know….the dollar is carrying a nearly 1:1 inverse correlation to stocks and commodities. In short, Powell and Mnuchin NEED the USD down to pump asset prices. We haven’t fully pivoted to this set up yet, but some of you know that we’re slowly making that turn. If we’re moving to a Growth/Inflation slowing backdrop in Q4, we’ll be buying dollars, shorting tech (Nasdaq), and shorting commodities. What’s leading to this possible conclusion is the high sustained levels of unemployment and the eventuality that it makes its way into the commerce data, which ultimately hurts growth in Q42020 compared against Q4 2019/2018. We saw the retail sales data this week, which expressed a m/m and y/y decline - Consumer sentiment is released in about 1hr.

Global Equities:

US firm with the SP500 +0.25 and NQ +0.55%

Europe was down overnight with GER +0.10%, UK -0.42%, SPA -1.44%, FRA -0.56%

Asia, particularly China had a big night with the Shang +2.06%, and KOSPI +0.26% (we remain bullish on China as they experience Scenario 2 economically)

Volatility:

VIX and VXN remain in a “volatile state” >26.00 for the VIX and >32.00 VXN is not a friendly signal to US Equities

Commodities:

Energy- OPEC was out yesterday talking up Oil prices. Plenty of cheating/non-compliance occurred over the last few months regarding the agreed upon production cuts. In short, countries were pumping more Oil than they agreed upon. We’ve also seen strong downgrades to global demand on forward looking basis. The OPEC oil minister basically warned speculators to not bet against OPEC as they stand ready and willing to further cut production. Interesting, sounds like they may be a little paranoid of another “risk off” scenario in Q4. We may short Oil for a trade soon.

Metals- a washout in Gold and Platinum prices yesterday, we’ll continue to remain bullish of the precious metals complex FROM THE LOW END OF THEIR RESPECTIVE RANGES. There is a potential for a larger washout in prices, however.

Actionable Ranges: