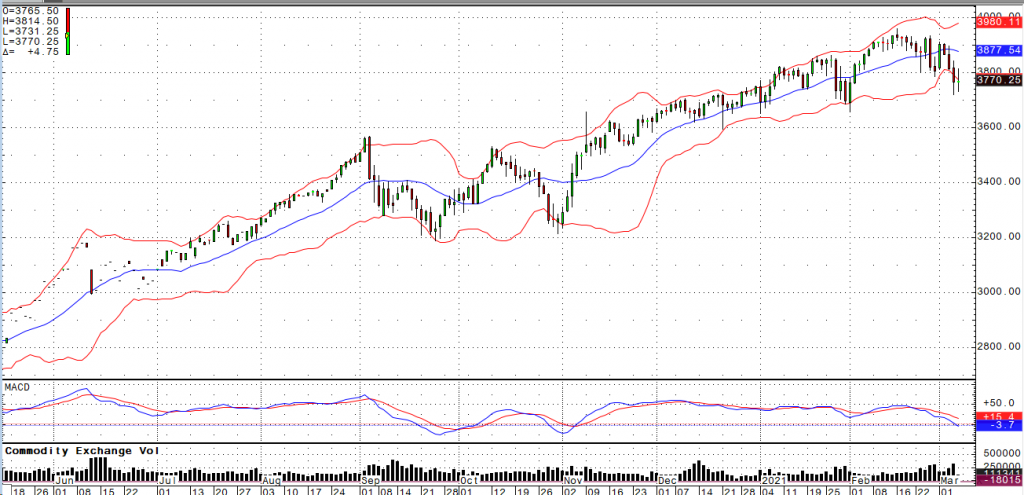

Gold has been sliding lower since January 6th. It’s not a coincidence that Treasuries Futures have also been sliding lower since January 6th. The next date on the daily chart that you should pay attention to is February 11th. That is the day that the selling accelerated. So why is gold being liquidated while treasuries move lower? Because interest rates are moving higher. Yields are returning to the “savers”! There is very suddenly a new way to get real returns on your money. Rates have moved very fast and now even Fed Chairman Powell cannot ignore inflation any longer. He had to acknowledge publicly now that as the economy reopens, inflation will rise. Well no kidding! Commodity traders see inflation all over the place. Lumber is at all time highs. Copper is at 11-year highs. Crude oil is over $65.00. RBOB gasoline is over $2.05 today. Grain markets are at 7-8-year highs. This is inflation. It’s not yet runaway inflation, but Washington wants yet more stimulus and then they’re going to finally look to spend more taxpayer dollars on “infrastructure”. There are too many dollars out there already. The economy is growing. The economy is NOT going to slow down as we reopen.

So why do I think that gold is near a bottom? The short answer is that I see longer term support around $1,675 to $1,650 and gold has reached oversold levels now. But more importantly because I still believe that gold is and will continue to be a good inflationary hedge. The rotation out of risky assets and into the safe returns in treasuries will slow. The bond market is telling us all that inflation is here. Once we embrace this inflation, gold prices will begin to march higher.