RJO FuturesCast

August 27, 2020 | Volume 14, Issue 35Feature Articles

New: Metals Investor Kit

Opportunities Exist in the Metals Markets Right Now –

Precious metals like gold and silver seem to be all anybody is talking about these days, and with good reason! Have you ever wanted to get in on these current opportunities in the metals but didn’t know where to start? Our Metals Investor Kit has you covered. Whether you are experienced or new to trading, our kit will give you the tools to take advantage of the opportunities that exist in the metals markets right now!

RJO Futures PRO Trading Platform

FREE 100k Simulated Trading Account

Experience a trading platform like no other with integrated tools to seamlessly trade and monitor the markets. With a free simulated trading account and personal broker experience, we’ll teach you about futures trading and help you develop a trading strategy.

The Markets

Oil prices are moving lower on Thursday amidst the landfall of Hurricane Laura in the Gulf of Mexico shutting down oil rigs and refineries. On Tuesday, oil producers had shut down nearly 84% of the Gulf’s production or removed about 1.5 million barrels a day. However, don’t expect this disruption in supply to be longstanding as oil and gasoline stocks remain well above year ago levels. However, to note crude oil stocks have declined nearly 25 million barrels over the last 5 weeks with US exports reaching a 15-week high this week, which should help underpin prices. Gasoline stocks fell and refiners increased production to the highest rate since March, according to the EIA. Expect any disruptions in supply to be temporary with renewed focus on demand prospects. The market remains bullish trend with today’s range seen between 41.88 – 43.85.

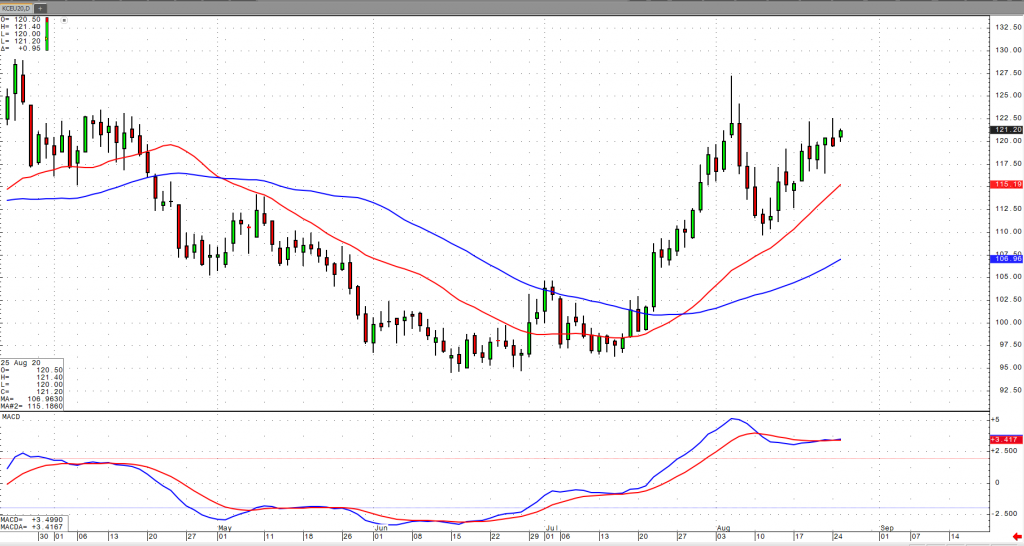

The recent rally sparked by a strong US and European stock market has lent some solid support to the September coffee futures. As we continue to struggle with our restaurants and coffee shops being handcuffed to limited revenues by way of limited occupancy, more and more of these cherished businesses will continue to vanish permanently. This sad reality is eminent and although the stock markets have shown signs of optimism, we can expect it will take quite some time to return these businesses back to pre-Covid 19 conditions.

While several States are still struggling with keeping business open, many believe the only way forward will be to actually “move forward” and reopen these restaurants. Traders should continue to remain cautious while speculating, as we await more treatments and ultimately a vaccine that will slowly allow our population to move back to normal. Until that day, expect that coffee prices will continue to suffer volatile swings and major moves. I’ll say it again, until that day when restaurants are permitted to increase their level of capacity (or even remain open), home coffee sales will not be nearly enough to offset the gaping void of demand left unfilled by restaurants and coffee shops. From a technical perspective, a retest of the 122 level should take place over the next week and this upward move will put September coffee prices smack-dab in the middle of a well-defined trading range last seen in April.

Posted on Oct 14, 2022, 07:42 by Dave Toth

On the heels of mid-Sep-to-early-Oct's steeper, accelerated, 3rd-wave-looking recovery, the past week-and-a-half's boringly lateral chop is first considered a corrective/consolidative event that warns of a continuation of the uptrend that preceded it to new highs above 04-Oct's 891.0 high. This count remains consistent with our broader base/correction/recovery count introduced in 13-Sep's Technical Blog following that day's bullish divergence in short-term momentum above 07-Sep's 809.5 minor corrective high detailed in the hourly chart below.

The important takeaway from this month's lateral, sleepy price action is the definition of Wed's 851.5 low as the end or lower boundary of a suspected 4th-Wave correction. A failure below 851.5 will confirm a bearish divergence in daily momentum and defer or threaten a bullish count enough to warrant non-bullish decisions like long-covers. A failure below 851.5 will not necessarily negate a broader bullish count, but it will threaten it enough to warrant defensive measures as the next pertinent technical levels below 851.5 are 13-Sep's prospective minor 1st-Wave high at 813.8 and obviously 08-Sep's 766.0 low. And making non-bullish decisions "down there" is sub-optimal to say the least. Per such, both short- and longer-term commercial traders are advised to pare or neutralize bullish exposure on a failure below 851.5, acknowledging and accepting whipsaw risk- back above 04-Oct's 891.0 high- in exchange for much deeper and sub-optimal nominal risk below 766.0.

On a broader scale, the daily log scale chart above shows the developing potential for a bearish divergence in daily momentum that will be considered confirmed below 851.5. This chart also shows the past month's recovery thus far stalling in the immediate neighborhood of the (888.0) Fibonacci minimum 38.2% retrace of Apr-Sep's entire 1128 - 766 decline). COMBINED with a failure below 851.5, traders would then need to be concerned with at least a larger-degree correction pf the past month's rally and possibly a resumption of Apr-Sep's major downtrend.

Until and unless the market fails below 851.5 however, we would remind longer-term players of the key elements on which our bullish count is predicated:

- a confirmed bullish divergence in WEEKLY momentum (below) amidst

- an historically low 11% reading in out RJO Bullish Sentiment Index and

- a textbook complete and major 5-wave Elliott sequence down from 29-Apr's 1128 high to 08-Sep's 766.0 low.

Thus far, the market is only a month into correcting a 4-MONTH, 32% drawdown, so further and possibly protracted gains remain well within the bounds of a major (suspected 2nd-Wave) correction of Apr-Sep's decline within an even more massive PEAK/reversal process from 17-May's 1219 high on an active continuation basis below.

These issues considered, a bullish policy and exposure remain advised with a failure below 851.5 required to defer or threaten this call enough to warrant moving to a neutral/sideline position. In lieu of such weakness, we anticipate a continuation of the past month's rally to new highs and potentially significant gains above 891.0.

USD: With the markets highly sensitive to the outcome of the US Fed reserve chairman’s speech today, it is not surprising to the see the currency markets consolidating early on this week. In my opinion, the dollar is vulnerable to another downward move like what we saw from May to August, especially if the FED maintains its stance today without noting any change in conditions. Basically, there are signs of global recovery and there are also signs of growth in the US, but if we see the FED maintain its support as well as not raising rates, the USD should remain bearish.

Looking at the trade today in the September 10-year note, we have a high overnight at 139-155 and we are currently on the low at 139-005 as of this writing. What’s noteworthy today is that we broke a major moving average, the 50-day at 139-11 and approaching another key moving average in the 100-day which currently lies at 138-30. This key moving average held twice in the last month on August 13th and 14th. If we pierce this level again, watch out below as the trend will firmly be on the downside. Traders will be watching close on Thursday as Fed Chairman Powell will speak at the Fed’s annual Jackson Hole conference, albeit virtually. He will most likely talk about rates and inflation. If he happens to discuss the possibility of not keeping rates at zero or if he sees the slightest move up in inflation, one should expect fireworks in both treasuries and stocks. The main catalyst for the monster move up in stocks has been the continued talk of rates being kept near zero, which in turn make stocks the most attractive investment that’s available for investors.

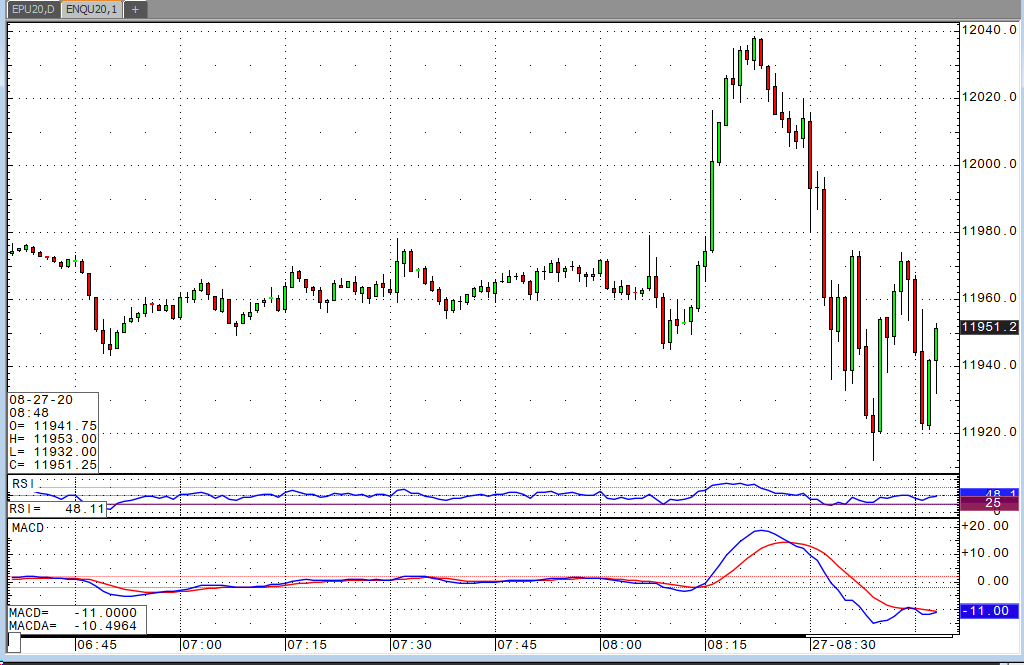

The S&P and Nasdaq were underwater heading into Fed Chair Jerome Powell’s statement from Jackson Hole, Wyoming. During the speech, we saw a nice rally, but it has quickly faded. The big takeaway from the speech was that they will allow inflation to run above their stated target rate of two percent. Their new policy will be one of “average inflation targeting.” In other words, following periods where inflation is running below their two percent goal, they’ll allow it to run above two percent for a given period to average two percent. He also cited the risks that extended periods of low inflation can present to the economy, acknowledged that the Fed has been unable to achieve their two percent target, and reiterated that they remain firm in their belief that two percent is the ideal target rate.

Posted on Nov 08, 2022, 07:51 by Dave Toth

In Fri's Technical Webcast we identified a minor corrective low at 2.6328 from Thur as a mini risk parameter the market needed to sustain gains above to maintain a more immediate bullish count. The 240-min chart below shows the market's failure overnight below this level, confirming a bearish divergence in very short-term momentum. This mo failure defines Fri's 2.8172 high as one of developing importance and a parameter from which very short-term traders can objectively base non-bullish decisions like long-covers.

Given the magnitude of the past three weeks' broader recovery however, this short-term momentum failure is of an insufficient scale to conclude anything more than another correction within this broader recovery from 26-Sep's 2.1877 low. Indeed, overnights failure below 2.6328 only allows us to conclude the end of the portion of the month-and-a-half rally from 31-Oct's 2.4822 next larger-degree corrective low. 2.4822 is the risk parameter this market still needs to fail below to break the uptrend from 18-Oct's 2.3526 low while this 2.3526 low remains intact as the risk parameter this market needs to fail below to break the month-and-a-half uptrend. From an intermediate-to-longer-term perspective, this week's setback falls well within the bounds of another correction ahead of further gains. This is another excellent example of the importance of technical and trading SCALE and understanding and matching directional risk exposure to one's personal risk profile.

The reason overnight's admittedly minor mo failure might have longer-term importance is the 2.8172-area from which it stemmed. In Fri's Technical Blog we also noted the market's engagement of the 2.8076-to-2.8159-area marked by the 61.8% retrace of Jun0-Sewp's 3.2758 -2.1877 decline and the 1.000 progression of Sep-Oct's initial 2.1877 - 2.6185 (suspected a-Wave) rally from 18-Oct's 2.3526 (suspected b-Wave) low. We remind longer-term players that because of the unique and compelling confluence of:

- early-Aug's bearish divergence in WEEKLY momentum amidst

- historically extreme bullish sentiment/contrary opinion levels in our RJO Bullish Sentiment Index

- an arguably complete and massive 5-wave Elliott sequence from Mar'20's 0.4605 low to Jun's 4.3260 high (as labeled in the weekly log active-continuation chart below) and

- the 5-wave impulsive sub-division of Jun-Sep's (suspected initial 1st-Wave) decline

The recovery attempt from 26-Sep's 2.1877 low is arguably only a 3-wave (Wave-2) corrective rebuttal to Jun-Sep's decline within a massive, multi-quarter PEAK/reversal process. Now granted, due to the magnitude of 2020 -2022's secular bull market, we discussed the prospect for this (2nd-Wave corrective) recovery to be "extensive" in terms of both price and time. A "more extensive" correction is typified by a retracement of 61.8% or more and spanning weeks or even months following a 3-month decline. Per such, the (suspected corrective) recovery from 26-Sep's 2.1877 low could easily have further to go, with commensurately larger-degree weakness than that exhibited this week (i.e., a failure below at least 2.4822) required to consider the correction complete. Indeed, the daily log chart above shows the market thus far respecting former 2.6185-area resistance from 10-Oct as a new support candidate.

These issues considered, very shorter-term traders have been advised to move to a neutral/sideline position following overnight's momentum failure below 2.6328, with a recovery above 2.8172 required to negate this call, reaffirm the recovery and re-expose potentially significant gains thereafter. For intermediate- and longer-term players, a bullish policy and exposure remain advised with a failure below 2.4822 required to threaten this call enough to warrant neutralizing exposure. We will be watchful for another bearish divergence in momentum following a recovery attempt that falls short of Fri's 2.8172 high that would be considered the next reinforcing factor to a count calling that 2.8172 high the prospective end to the month-and-a-half 2nd-Wave correction. In lieu of such, a resumption of the current rally to eventual new highs above 2.8172 should not surprise.

*Commodities, Commodities, Commodities – The commodity rally is broadening vs the equity rally. Agriculture joins the mix with Corn and Soybeans +3.00% and Soybeans +0.73% and +3.2% on the week. Metals caught a strong bid yesterday, consolidating gains this morning.

*Key events today include US Jobless Claims and Q2 GDP (2nd estimate) due out at 7:30am CST

*The highlight of today with Fed Chairman Jerome Powell’s speech at the Jackson Hole Economic Symposium at 8:00am CST

-Powell largely expected to move the goal posts on the Fed’s 2% inflation target, allowing inflation to run a little above expectations

-Largely expected to have a “lower for longer” outlook on interest rates

*Commodities broaden their rally as Agriculture prices begin to climb

Global Equities

*US is largely in a holding pattern this morning, following another record day in the SP500 and NASDAQ

*Europe traded lower across the board in the overnight led by the IBEX in Spain -0.84%

*China’s Shanghai Index is up +0.64%

Top Market Movers Overnight

Agricultures

*Soybeans continue their climb to 931’0 bushel – remain bullish of US Farm Products. 950-960 remains and upside target for beans in coming weeks – well done

* Lean Hogs are in a developing “bearish to bullish” transition. Oct Hogs are trading at 55.575 with immediate upside potential to 60-62.50

*Agriculture markets begin to price in the prospect for Chinese demand as the key driving force behind the rally

Metals

*Gold and Silver staged strong rallies yesterday – consolidating those gains this morning ahead of Fed Chair Powell’s speech

*Gold has potential to re-test 2000-2020 in coming weeks

*We still largely contend that both Gold and Silver remain largely “range bound”, and that traders should continue to hold a bullish bias

Energy

*Laura makes landfall, but has been downgraded to a Cat 2 vs yesterday’s Cat 4.

*Crude Oil and RBOB trade lower as its being reported western Texas Oil operations are likely to continue

*Energy is likely to fall into a “buy pocket” before another test of higher levels. Long side trade still

*Natural Gas, similar to Energy – looking for a 2-3 day correction before a window opens for a Long side trade

Conclusion-

You must have Commodities as a part of your portfolio as Powell looks to run the economy and inflation “Hot” in coming quarters. A weaker Dollar and a “lower for longer” outlook on interest are contributing factors to our commodity outlook, along with an improved economic backdrop over the next 12 months, specifically in China (The World’s largest consumer of commodities).