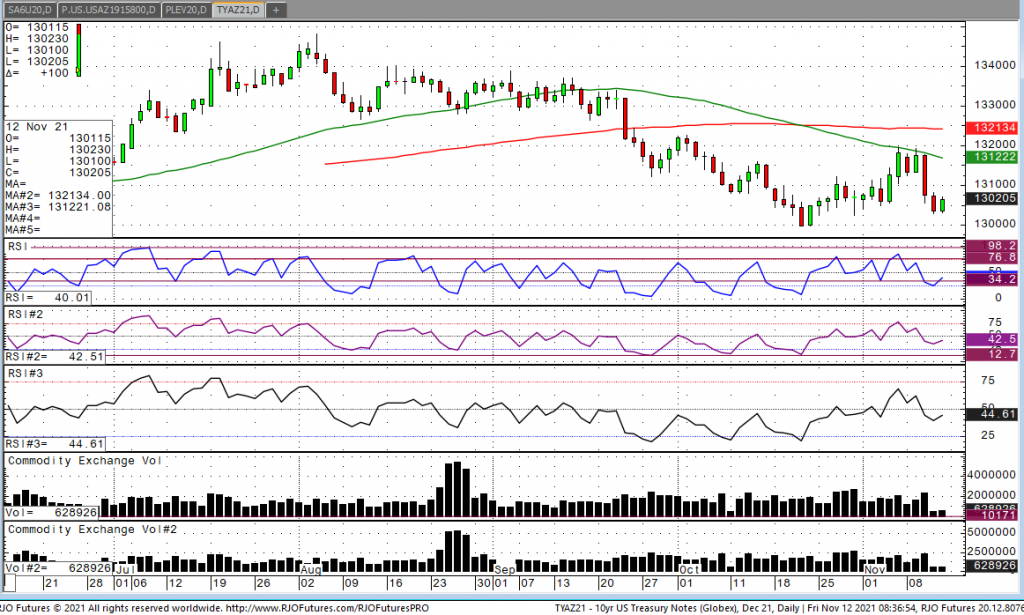

It’s about time, isn’t it? Explosive upside breakout in gold has finally happened. It’s never been a question of if, just a question of when. Of course, it is about gold traders looking for an inflationary hedge, but it is equally due to the technical buying that was triggered by a close at $1,834 this past Tuesday. Some talking heads out there are going to tell you it’s about a “dovish” Fed. I say it’s about heated inflation data. It’s about the idea that rates will move higher before the Fed starts real tightening and not just tapering. The market will do its job! Look at how ten-year note yields have moved this week also. There’s a direct correlation. Now that gold has begun to move higher, dips are likely to be shallow and good opportunities to add to long positions. I would like to see that gold can hold levels above $1,835. A close under $1,825 would be a game changer and considered a reversal. A pop over $1,875 and we will be at $1,900 in short order. Gold trade may take a little breather and chop between $1,835 and $1,875 for a short time before moving higher again. This was a big move and happened fast. That’s how technical buying works.

Inflation is impacting everything, everywhere! Gold should continue to be attractive under $2,000. Once it reaches above $2,000

The strength in the US dollar comes from the prospect of rate hikes and dollar strength can put pressure on all commodities. Those dips in commodities are more temporary in nature. Commodities are in a super cycle bull market and now that gold traders can see that inflation is here to stay, gold will continue to move higher in my opinion.