What is Systematic Risk?

Systematic Risk can be defined as the risk correlated with the entire market or market segment. Systematic risk may also be referred to as “volatility”, “undiversifiable risk”, or “market risk”. Unfortunately, systematic risk is impossible to completely avoid, simply because of its unpredictability. You can mitigate risk by diversifying and hedging, but your portfolio will still be at risk.

Types of Systematic Risk

Underneath the umbrella of systematic risk there are different types of risk. These types of systematic risk are known as: market risk, exchange rate risk, purchasing power risk, and interest rate risk. Each type of risk, while similar in nature, do have distinct differences from one another.

Underneath the umbrella of systematic risk there are different types of risk. These types of systematic risk are known as: market risk, exchange rate risk, purchasing power risk, and interest rate risk. Each type of risk, while similar in nature, do have distinct differences from one another.

Market Risk

Market risk is the most popular type of systematic risk and is the most prominent risk when working with securities. Market risk occurs when investors follow a “group think” type of thought process, which means that investors follow other investors and the current direction of the market, which causes security prices to all move together. For instance, if the market is declining, and investors are following this type of “herding” pattern, even stocks that are considered good will have a fall in share price.

Exchange Rate Risk

Exchange rate risk is a very niche type of risk that is generally only associated with foreign investments. When dealing with foreign currencies there is always uncertainty when it comes to valuation because currencies fluctuate constantly, this uncertainty is known as exchange rate risk. As mentioned previously, you only have to worry about this type of risk if you are dealing with companies who facilitate foreign transactions or are large export companies. There is no real way to mitigate exchange rate risk other than to be aware of it.

Purchasing Power Risk

Purchasing power risk, also known as inflation risk, is the type of risk that arises due to inflation. When inflation occurs, it decreases the value of money and investments because its lowers the value of the dollar, thus driving up the price of goods, services, and investments. Often times, an individual’s wage or salary does not keep up with the price of inflation, making it difficult for them purchase things, such as stocks. Purchasing power risk is most prevalent in fixed income securities because income from these securities is set to nominal terms. A good way to mitigate or work against purchasing power risk is to invest in equity shares because they are less susceptible to inflation.

Interest Rate Risk

Interest rate risk is the final type of systematic risk, this type of risk occurs when there are changes in the interest rates market. This type of risk mostly effects bonds and other fixed income securities because their valuation is based off of interest rates and they have an inverse relationship to the stock market. When stocks go up, interest rates go down, and when stocks go down, interest rates go up. There are two components that makeup interest rate risk: price risk and reinvestment risk. Price risk deals with the change in the price of a bond or security, while reinvestment risk deals with reinvesting the dividend or income. These two factors have an inverse relationship as well. If the price of a security falls (aka negative price risk), the reinvestment risk would be positive, meaning an increase in earnings on the money reinvested.

Unsystematic Risk

While unsystematic risk is a separate entity from systematic risk, it should be touched upon. Unsystematic risk refers to the risk associated with investing in an individual company or product. This can come in many forms, but the most popular ones are: emerging competitors, product recalls, new management, or new regulations, or anything else that can devalue a company or lower their sales. For instance, say you had recently bought shares in apple because they’re coming out with a new iPhone that will “change the game”. Shortly after Apple announces that phone, Microsoft decides to announce a smart phone aimed to compete with the new iPhone, that would be an example of unsystematic risk. What makes unsystematic risk different from systematic risk is that is unpredictable and deals only within the marketplace of a certain investment/company, not the market as a whole.

Total Risk

Total risk, as I’m sure guessed, the total amount of risk involved in an investment. This includes both systematic and unsystematic risk, in addition to any other extenuating circumstances involved in an investment. One way to identify total risk is to perform a risk assessment. A risk assessment will analyze and offer a sneak-peak and any threats a potential investment may face, with the goal of providing you, the investor, the most information as possible before making a decision.

Mitigating Systematic Risk

Using a wide variety of asset classes like fixed income and cash is one way to mitigate systematic risk because each asset class reacts differently to systematic change. For example, take a look at the Great Recession of 2008. When the recession hit risky securities and stocks were decimated and sold off in large quantities. Meanwhile, simple assets like treasury bonds gained more value because they are generally perceived as a safer option and people were buying them up as they sold off stocks. An individual who was invested in both would have mitigated their systematic risk, as opposed to somebody who was only invested in stocks.

Beta Explained

While you cannot exactly quantify how much systematic risk your portfolio is vulnerable to, you can get a relatively close idea by looking at your portfolio’s beta. A beta is a tool used to measure how mercurial an investment is in coherence with the market as a whole.

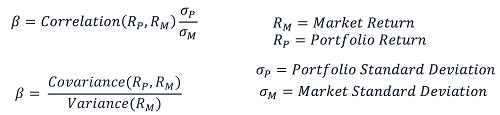

Beta can be calculated using the following formula. (source: corporatefinanceinstiture.com)

- When the beta has a value greater than 1, there is more overall risk

- When the beta has a value less than 1, there is less overall risk

- When the beta has a value of exactly 1, there is no more or no less overall risk.

Systematic risk is never unavoidable because the economy is always in flux. However, it is manageable and something that should be looked at and heavily considered before one decides where and how to invest.