A bullish call spread option, also known as a bull call spread option, is a trading strategy that aims to capitalize in an increase in the price of a given market or asset. The bull call spread option strategy consists of two call options that create a range that outlines a lower strike point and an upper strike point. The bullish call spread strategy helps to cap loss if the price of an asset drops, however, the strategy also caps the amount of potential gains in case of a price increase. Bullish investors often use this when trading futures, bonds, and equities. This strategy is categorized as a debit spread, not to be confused with a credit spread.

What Are Call Options

As we mentioned earlier, a bullish call spread is put in place by the use of two call options, however you may not know what a call option is. Call options for bull call spreads are another tool investors use to create an advantage in case of upward price movement. If the investor decides to exercise the call option before the expiration date of the asset, they are granted the option to buy the contract at a previously determined price (strike point) however they are not required to do so. This technique is useful to bullish investors who believe the price will go up.

In order to place a call option, the investor has to pay a premium. The premium is determined by the spread between the current price of the contract and the strike price. The closer the strike price is to the actual contract price, the higher the premium is. Here is where it gets complicated. If the price of the contract or asset falls below the price of the strike point, the investor will decide to not buy a contract and will lose the money they paid for the premium. However, if the asset price rises above the strike point, the investor may purchase the contract at that price, but still will not recoup the premium. It is important to pay attention to the price of the premium. Some premiums may be so high that they make buying the call option worthless because it would take a major move to hit your breakeven point (BEP).

How To Manage a Bull Call Spread

In order to manage a bullish call spread, we first have to build one. The first step in building a bull call spread is finding the contract you want to buy. Remember you need to believe that the futures contract will outperform the actual asset. Once you have the contract, you need to structure the bull call spread. You do this by purchasing a call option above the current price of the asset with a set expiration date (also known as long call). Simultaneously, you will also sell a call option at a higher strike point (also called a short call) thus creating a range. When you sell the call option at the higher strike point, this creates the premium which will help offset the call price you paid for the long call.

How to Calculate a Bull Call Spread

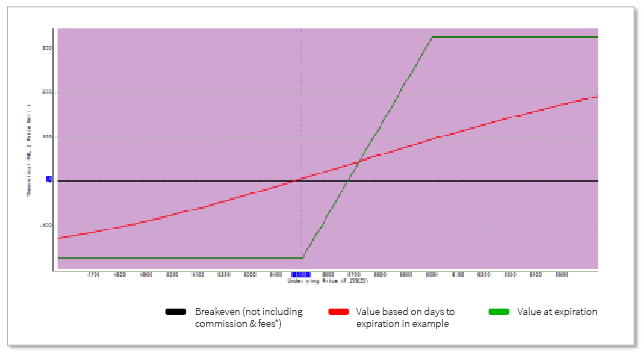

Now that you have the premium, you can calculate your max profit and losses. The max loss is calculated by simply multiplying the (net premium spent). The sum of that calculation is the most you can possibly lose. Now we need to calculate your max profit. You get that number by doing (call spread width – premium spent).

How to Close Out a Bull Call Spread

Once you have your bull call spread built, you can now wait out the expiry date you chose when you purchased your long and short call options or sell ahead of the expiration date. As mentioned previously, if at expiration or time of sale, the asset price dips below your lower strike point you would not exercise the option and you would be out the premium. However, if the asset goes higher than your short call strike point, you have the option to buy the asset at the lower strike point (long call), which is below current market value. In addition, since you are purchasing your long call option, your short call option is still active. You can then sell the contracts bought at that lower strike point (long call point) at the price of your higher strike point (short call point), minus the premium, thus creating your capped profit.

Example of a Bull Call Spread

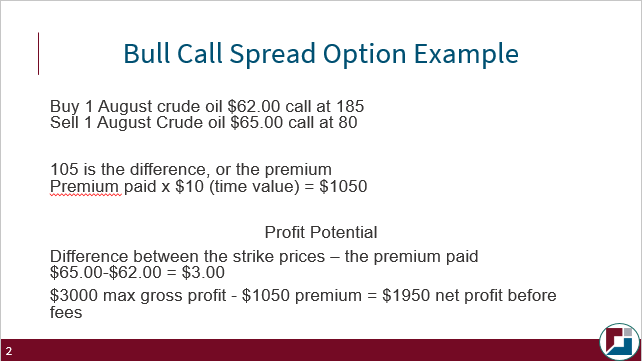

In this bull call spread example, we are using a crude oil contract. We are buying 1 August crude $62.00 call at 185 as our long call. We then simultaneously sell 1 August crude $65 call at 80 as our short call. This action creates our premium, which is 105. We then multiply that by 10 to account for the time value to get $1050, or our total premium paid.

Once we have our premium figured out, we can calculate what our potential max profit is simply by taking the difference in our strike prices, which in this case is $3.00, which we then multiple by 1000 because this is a futures contract. That gives us a grand total of $3000 as our max gross profit, minus our $1050 premium, leaving us with a max net profit of $1950.

When to Use a Bull Call Spread

A bull call spread is best used during times of high volatility. If you have an inkling that the price of a contract is going to rise moderately, and the market is exceptionally volatile, a bull call spread would be the trade to use. As we mentioned, you want to use this during times of volatility because it caps your max losses. While you may not be able to make as much money in the long run, the security of knowing how much you can potentially lose during a volatile market is a fair trade off.

Tips for Trading a Bull Call Spread

- Calculate risk – risk calculation should be your first step before placing any trade, and a bull call spread is no exception. Be sure to research the asset you plan on purchasing and make sure you have good indication there will be a moderate rise in price.

- Calculate your profit potential – make a dry run sheet of your potential trade and use real numbers. For example, if you purchase a long call on corn at x price and a short call at x price, what would your max profit be and how much would the price of corn have to move for you to achieve said profit.

- Make sure the trade is worth your while – make sure the premium you are paying is low enough that you are still making money if the price rises. You don’t want your profit offset by your premium.

Do your research and look at historical charts – before placing a bull call spread make sure you know everything about them. Read up on historic examples or better yet, contact one of our experienced RJO Market Strategists