Put simply, durable goods are products that do not need to be purchased often, whereas non-durable goods are products that expire more quickly. The rule of thumb for this is, if it lasts longer than 3 years, it is a durable good, and if it lasts less than 3 years, it is a non-durable good.

Durable Goods

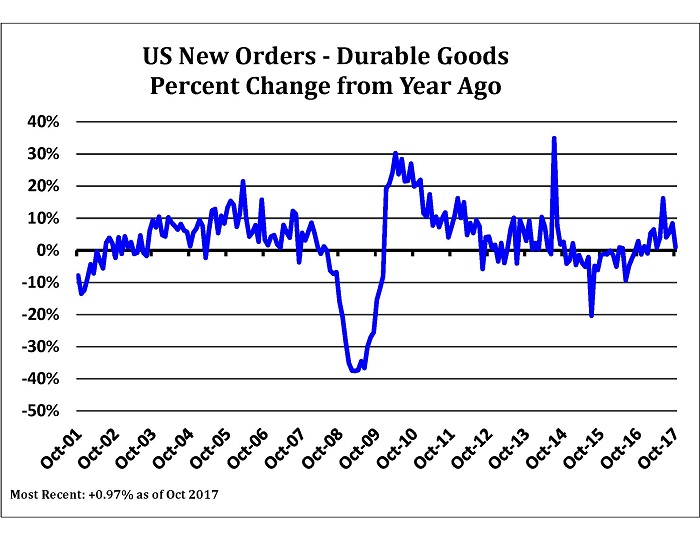

Durable Goods Orders are an economic indicator released monthly by the Census Bureau. It reflects new orders placed with domestic manufacturers for the delivery of factory hard goods. A hard good is a good that does not quickly wear out. It yields utility over time instead of being consumed in one use. Items like bricks would be considered durable goods because ideally they should never wear out. Durable goods are also classified as items that have long periods between successive purchases. They usually include cars, home appliances, consumer electronics, furniture, sports equipment, firearms and toys. When durable goods are selling well, it generally indicates a positive economy. When sales are down, so is the health of the economy.

Non-Durable Goods (Soft Goods)

Non-durable goods or soft goods are the opposite of durable goods and are called consumables. They may be defined as goods that are immediately consumed in one use or have a lifespan of less than three years. Examples of non-durable goods include cosmetics, cleaning products, food, fuel, beer, cigarettes, paper products, rubber, textiles, clothing and footwear.

While durable goods can be rented as well as bought, non-durable goods are generally not rented. Buying durable goods come under the category “demand of goods,” whereas buying non-durable goods come under the category of “consumption of goods.” What kind of a consumer are you?