Currency Futures Basics

A currency futures contract is a legal agreement between a buyer and a seller. In this agreement, the buyer has the obligation to take delivery of the currency at a specific price by a specific date. As a result, the buyer is said to be “long” the currency. The seller is obligated to deliver the currency by a specific date. In this case, the seller is said to be “short” the currency.

In the vast majority of cases, buyer and seller will exit their agreement before the expiration date, meaning no currency is physically delivered.

Instead, market participants will realize a profit or loss depending on whether the price of the futures contract has increased or decreased. Currency futures essentially behave in the same way and have the same standardized characteristics as any other type of futures contract, with one slight difference. There is no centralized exchange for currency futures, as is the case for other futures such as commodities or indices. Instead, several exchanges in the United States and abroad are responsible for trade flow, with the Chicago Mercantile Exchange conducting the majority of currency futures trades. It is important to keep in mind though, that currency futures are not over-the-counter products.

1. Volume and Open Interest

The number of currency futures contracts bought or sold in any given period is measured as Volume, and represents trading activity. The greater the Volume, the more contracts have been exchanged. Traders interpret Volume as the intensity behind a trend: the greater the Volume, the greater the possible trend intensity.

Open Interest measures trade flow by showing the number of “open” contracts at the end of a trading day. When a new contact is opened (i.e. a trader buys a contract from a seller), Open Interest will increase by one. Conversely, it will decrease by one when buyer and seller close out a position. When Open Interest is increasing, it can signify new market participants entering the market. Volume and Open Interest, combined with price, can reveal the strength of the prevailing trend.

| Price | Volume | Open Interest | Trend Interpretation |

|---|---|---|---|

| Increasing | Increasing | Increasing | Strong |

| Increasing | Decreasing | Decreasing | Weakening |

| Decreasing | Increasing | Increasing | Weak |

| Decreasing | Decreasing | Decreasing | Strengthening |

2. Characteristics of the underlying currency

Price movements of currency futures are almost entirely influenced by the behavior of the underlying currency. In this section we will look at the characteristics of some of the major currencies.

U.S. Dollar Index

(USDX) weighs the value of the USD against the Euro, British Pound, Japanese Yen, Swiss Franc, Canadian Dollar and Swedish Krona. It is an extremely reliable benchmark of the greenback and traders use it to measure dollar weakness or dollar strength. The USDX futures are traded on the Intercontinental Exchange (ICE).

Euro FX

Although the Euro is a relatively new currency, launched in 1999, it has become one of the most traded currencies. It is influenced heavily by the economies of member states, European consumer price inflation, as well as interest rates set by the European Central Bank. Euro futures are traded on the CME as a full Euro FX contract (EC). It is also possible to trade the smaller e-mini Euro FX contract (E7).

British Pound

The British Pound (GBP) is the fourth- largest traded currency. Many complex fundamental factors influence GBP – in particular, UK Inflation and Gross Domestic Product (GDP). It can also be sensitive to domestic events in the UK’s turbulent political scene. British Pound futures are traded on the CME Globex Exchange.

Japanese Yen

The Japanese Yen is the strongest and most traded currency in Asia. For many years the Yen has been a popular currency for the carry trade, where investors borrow money from low- interest economies and invest abroad for higher returns. Japanese Yen futures are traded on the CME as both a full Japanese Yen contract (JY) as well as the smaller e-mini Yen contract (J7).

3. Contract Specifications

A key attribute of futures contracts is that they are standardized, and as a result, all contracts of the same type are identical. So, for example, all Euro futures possess exactly the same specifications. Due to this standardization, futures contracts can be freely and easily bought and sold. This allows buy/sell transactions to be conducted quickly and efficiently, and has created a highly liquid market, with a vast number of buyers and sellers.

However, different currency futures will have differing characteristics from one another. For example, a Canadian Dollar future will have a different margin requirement, symbol and contract size compared to a Swiss Franc future. A contract’s minimum point movement and tick value are two pieces of information that are essential for a currency trader to know and will vary between different currency futures.

This and other important contract specifications are summarized in the table below.

| Contract | Symbol | Exchange | Tick Size | Contract Unit |

|---|---|---|---|---|

| US Dollar Index | DX | ICE | Electronic | $1,000 x index |

| Euro FX | EC | CME | 0.0001 = $12.50 | EUR 125,000 |

| E-mini Euro FX | E7 | CME | 0.0001 = $6.25 | EUR 62,500 |

| Japanese Yen | JY | CME | 0.000001 = $12.50 | JPY 12,500,000 |

| E-mini Yen | J7 | CME | 0.000001 = $12.50 | JPY 6,250,000 |

| British Pound | BP | CME | 0.0001 = $6.25 | GBP 62,500 |

| Australian Dollar | AD | CME | 0.0001 = $10.00 | AUD 100,000 |

| Canadian Dollar | CD | CME | 0.0001 = $10.00 | CAD 100,000 |

| Swiss Franc | SF | CME | 0.0001 = $12.50 | CHF 125,000 |

| New Zealand Dollar | NE | CME | 0.0001 = $10.00 | NZD 100,000 |

The Role of Margin in Currency Futures

In order to open a futures position, traders must deposit a minimum amount of capital in their trading account. This is called margin, and is based on a small percentage of the value of a futures contract. Margin is an essential concept for futures traders to understand. It is based on “leverage” – the principle of being able to control a large amount of money with a relatively small capital base.

One way to think of margin is like a down- payment on a house purchase. The down- payment is a relatively small amount of capital. But it provides a home-buyer with the leverage to control a larger amount – in this case, the value of the house. Futures margin works in the same way: it is a deposit and can be viewed as the down payment on a futures contract. Margin should not be viewed as a cost. They are simply funds held by a broker to offset any losses that may occur in a trade. Once a futures position has been closed out, the margined funds become available for use again.

In the context of futures trading, there are two types of margin.

1. Initial Margin

This is the amount required to open a futures position, whether long or short. The amount of the margin needed can vary from contract to contract and is based on the value of the contract. For example, the margin required for Euro futures may be $2,300, while the Australian Dollar futures could be $1,400.

2. Maintenance Margin

This is the amount of funds required to continue to hold a futures position. In the event the position goes against the trader by an amount greater than the maintenance margin, a “margin call” would be triggered. Additional funds will then be required to top the account back up to the initial margin level in order to ‘maintain’ the position.

In most cases, margin rates will be around 10%-15% of the value of a contract.Futures exchanges determine margin rates, which can be greatly influenced by market volatility. As volatility increases, margin rates could increase to compensate for the increased risk.

Why Trade Currency Futures?

There are two main reasons for trading currency futures: hedging and speculating.

1. Hedging

Currency futures can be used to protect against currency fluctuations. For instance, a company transacting in foreign markets in a foreign currency could use currency futures to lock in prices, thus protecting them from future price volatility.

2. Speculating

Speculators can range from individual traders to banks, financial institutions and even governments. All are looking to profit from price fluctuations. A number of methods can be used to make trading decisions including fundamental or technical analysis.

A trader believes that the GBP future has the potential for a sustained move to the upside. This decision is based on the fundamentals of the UK economy looking bullish for the currency as well as the technical analysis from the chart indicating bullishness. To capitalize on this belief, he decides to buy 5 GBP future contracts. For every 0.0001 tick increment in the GBP future, one contract would represent a dollar amount of

$6.25 per tick. With a position size of 5 contracts he stands to make or lose $31.25 per tick.

Trading Strategy for Currency Futures

The high liquidity and volatility of currency futures makes it a prime market for technical momentum trading strategies. Whether a trader is looking to ride an intra-day trend or capture a longer-term trend, finding and then trading market flow is a popular choice.

One such strategy is to identify a currency future that is in a strong trend, either bullish or bearish, and trade with this trend. Often trend traders will base their activity on higher time frames, such as the daily or weekly charts, however the lower time frames, such as the 15-minute chart, are popular with intra-day traders.

Trade Set Up

A valid trade set-up would be typified by four specific technical factors which need to be present simultaneously.

- Trending chart architecture

- Moving average spread

- Dynamic value zone

- Entry Candlestick

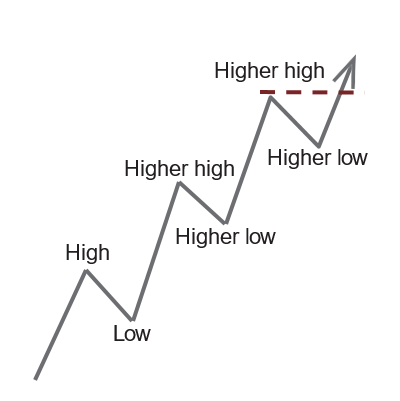

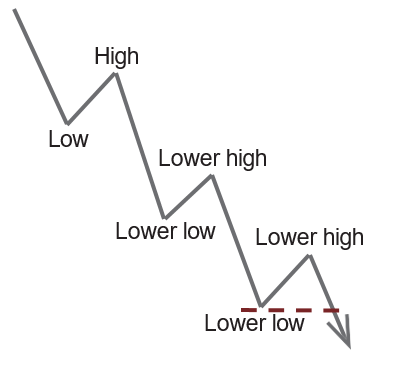

1. Trending chart architecture

Up-Trend: price action is making successive higher highs and higher lows

Down-Trend: price action is making successive lower highs and lower lows.

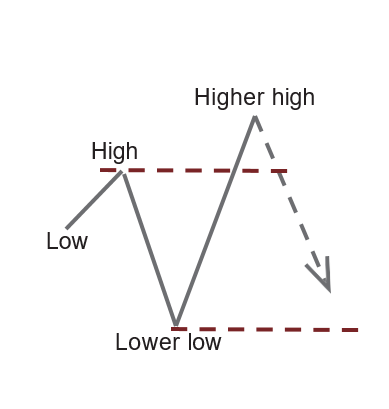

No Trend: price action is not making any clear series of highs or lows. No valid trend set-up.

Not only are we looking for the chart architecture to be either bullish or bearish, but the momentum should be smooth and steady, displaying no erratic price movements, gaps or spikes.

Spiky, erratic price action with price gaps

Smooth and steady price movement

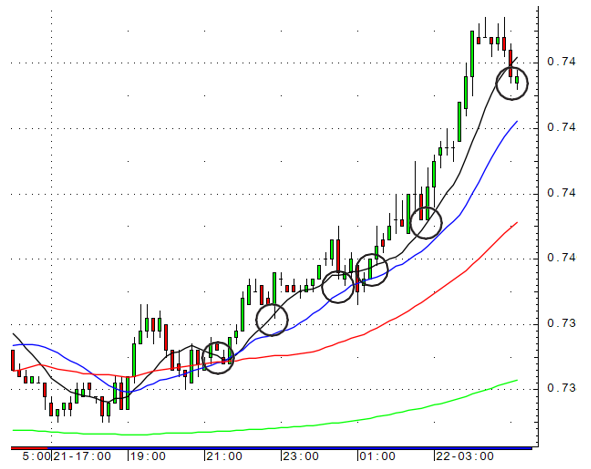

2. Moving Average Spread

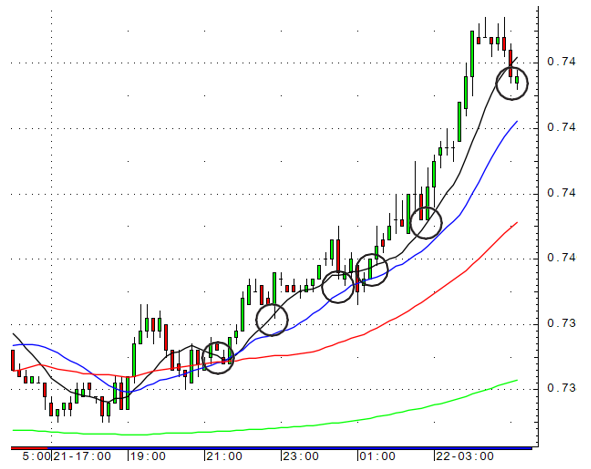

The second technical factor requires a spread of the 10, 20, 50 and 200 period simple moving averages (MA). This simply means the MAs are spreading out as they are rising/declining at a similar angle and there is a space in between them. The MAs will naturally form this spread pattern on a currency future that has had steady and consistent movement for a sustained period. As such the MA spread can be an indicator of good chart architecture.

3. Dynamic value zone

The dynamic value zone also uses MAs and helps with the timing of the entry. As price moves in an up-trend, it does so in waves. After each wave, price will often pullback into the MA in readiness for its next potential wave up.

Having taken a breather, the likelihood is that price will continue in the direction of the prevailing trend. Each pullback event offers an opportunity to join this trend. The area in between the 10 and 20 MA is called the Value Zone because when price pulls back into this zone it permits a trader to enter long or short at a more attractive price point.

Enter 1 tick below the low of the entry candle (when going short)

Example of a short dynamic value zone, made by the 10 and 20 MAs in a down- trending chart architecture.

4. Entry Candlestick

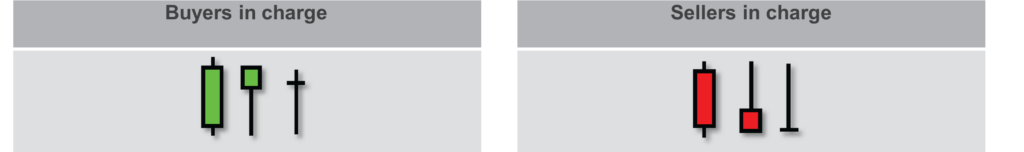

When the above three technical conditions have been met, we then need a suitable trigger to enter the prevailing trend. This trigger is defined by an entry candle. In an up-trending chart architecture, we look for a bullish candle (where the close is greater than the open). In a down-trending chart architecture, we look for a bearish candle (where the open is greater than the close). There is no need to focus on elaborate candle names or patterns. Instead we simply focus on finding out who is in charge – the bulls or the bears.

Entry rules:

- Enter 1 tick above the high of the entry candle (when going long)

- Enter 1 tick below the low of the entry candle (when going short)

Bullish Entry Candle Example:

Bearish Entry Candle Example:

5. Risk Management

A safety-first approach with stringent controls in place are essential to manage the risk of trading with leverage. Risk and money management should be at the core of any trading methodology. The fundamental risk management rules for this momentum strategy are as follows:

- Stop loss orders should be placed 1 tick below the low of entry candle (when going long) and 1 tick above the high of the entry candle (when going short).

- Profit Targets should be set in advance at a conservative 1:1, a more aggressive 2:1 or any amount based on the technicals of the chart.

- Position sizing relates to the number of futures contracts you enter in a trade. It is an important consideration as it is advisable to not risk more than 1% of your trading capital on any one trade.

Conclusion

The benefits of trading currencies range from the ability to hedge against foreign exchange risk through to speculating on intra-day, medium and long-term trends. Currency futures are shaped by the fundamental forces that affect countries and their economies. They can be highly technical in nature which gives traders, who can successfully apply technical strategies, an edge. The currency futures market is highly liquid and volatile. But by using the recommended tools and strategies, it is perfectly suited for banks, corporations and funds, as well as individual traders.