Basics of Options on Futures

Options on futures share many similar characters as stock options. They are contractual agreements that provide the right, but not the obligation, to buy or sell an underlying asset at a certain date at a set price. The premium is the price paid for the right to buy or sell assets and is otherwise referred to as the value of that option.

The premium component of an options is comprised of the current market price, intrinsic value, time until expiration, and volatility among other things. For more on option valuation and “The Greeks” (Delta, Gamma, Vega, Theta and Rho).

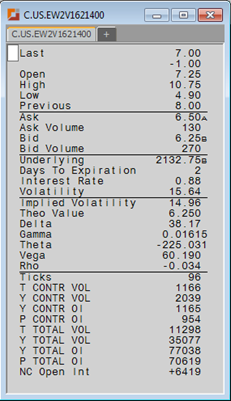

The SnapQuote function of the RJO Futures PRO trading platform will also provide clients with the Bid/Ask, the number of working orders at the Bid/Ask, the price of the underlying futures contract, days to expiration, interest rate, volatility, “The Greeks” and much more. If you would like a further explanation of how to read these quotes or would like a free 2-week trial of our RJO Futures PRO platform to practice trading weekly options, sign up for a demo account.

This chart shows an end of week 2 Oct’16 2140 call option in the e-mini S&P 500 market. The last trade was 7.00, which equates to $350 (7 x $50 per point). This price is also known as the “Premium” or price. Aside from current trade price, traders are also provided with the following:

When dealing with options on stocks, the underlying asset is 100 shares of stock.

In futures, the underlying asset is a futures contract in the same expiration month as the option. Options are a great way to fine-tune your trading approach beyond simply “buy if it’s going up” and “sell if it’s going down.” Many traders like the defined-risk aspect of purchasing options; however, that is not to say that options are entirely without risk. Along with directional expectations, the timing and magnitude of the anticipated move are also crucial factors that will impact an option strategies profitability or lack thereof.

Before going any further, we must first ensure a basic understanding of option characteristics. There are two types of options: puts and calls. A call option gives the buyer the right, but not the obligation, to buy a futures contract at a certain predetermined price (known as the “strike price”). A put option gives the buyer the right, but not the obligation, to sell the underlying futures market at a predetermined price. Options are unique in the sense that they allow participants the opportunity to buy (to go long) or sell (to sell short) the option in question. For more information on each strategy, I encourage you to review Table A.

| Strategy | View on the Underlying Futures Market | Gain Potential | Loss Potential |

|---|---|---|---|

| Long Call | Bullish | Unlimited | Defined |

| Short Call | Bearish | Defined | Unlimited |

| Long Put | Bearish | Unlimited | Defined |

| Short Put | Bullish | Defined | Unlimited |

The strike price is the price at which the market needs to be above (for a call) or be below (fora put) in order for the option to be labeled “in-the-money”. If at expiration, you are holding an in-the-money option, you will be assigned a long futures positions (for calls) or short futures position (for puts) from that strike price. When it comes to trading these options, an individual who generally believes that the market will rise would buy a call option and an individual who believes that the market will decline would buy a put option. Each option will have a specific contract month, which correlates with an underlying futures contract. Additionally, each option will have an “expiration date”, which is the date at which the option either expires or is settled.

When it comes to exiting an option positions, an individual can choose one of three ways: offset, exercise or expire. Traders looking to offset their option would sell (or buy back) their long (or short) option to offset their position prior to options expiration. A trader will exercise an option by allowing the option to “expire” in-the-money, at which point a long or short futures position will be assigned to the account at the given strike price. Option buyers assume a long position in futures by exercising a call or a short position in futures by exercising a put. If an option is not offset or exercised, it eventually expires. The buyer then loses all of the premium paid, while the seller profits by the amount of premium collected. Both buyer and seller may be charged commissions and fees.

Basics of Weekly Options

Now that we’ve solidified a basic understanding of some of the key phrases and concepts of options on futures, we can begin to discuss the basics of weekly options and how weekly options can be implemented into your trading strategy. Much like traditional options on futures, weekly options come in two forms: weekly put options and weekly call options.

As mentioned in our prior discussion of options, a weekly put option will give the option holder the right to exercise that option should the underlying futures market settle below the predetermined strike price of his or her put option, and vice versa. The intuition remains the same in the sense that participants that have purchased a put option anticipate a decline in the underlying futures price, and those who have purchased a call option expect prices to appreciate in value. If at option expiration, a weekly option holder chooses to take delivery, they will be assigned the futures contract that the option is based off of. For example, the October Weekly Options in the Emini S&P 500 are exercised with the December futures contract. One of the key defining features of weekly options, which we will discuss in further detail later in this guide, is the duration of the underlying option. Weekly options are typically offered on four to five separate expiration days, each Friday of the month. This allows participants additional flexibility and precision when it comes to constructing an option strategy.

Prior to the introduction of weekly options, traders were limited to only one option expiration date per month which, as you could imagine, significantly restricted the number of possible strategies. A majority of standard options will expire on the third Friday of the month and, as a result, it’ not uncommon to see weekly options listed for week 1, 2, 4, and 5 depending on the number of Friday’s in that month and with the exception of the standard options date. In the circumstance where the standard option expires on a Friday, the standard options contract for that month will take the place of the weekly options with the same expiration schedule.

Characteristics of Weekly Options

As you may have guessed, one of the defining characteristics of weekly options is their relatively frequent duration. Every option contract that you trade, including weekly options, will contain a contract month, underlying market, strike price, option type (put/call) and expiration date. Unlike traditional options that often expire the third week of every month, weekly options allow traders to specify which week they would like their options to expire on, thus providing traders with much more precision when it comes to the execution of an option strategy.

Additionally, the increase in expiration dates allows for more contracts to be exchanged on a daily basis, which ultimately results in higher volume and added liquidity in the marketplace. Given the short duration of these contracts, there is less of a “time premium” built into the cost of each options, which allows clients who anticipate a large directional move to benefit from the shorter time duration. This concept of “time premium” has to do with the way options are valued and, if you would like a further explanation of this concept, I encourage you to contact one of our experienced brokers here at RJO Futures for a further explanation of what this means and how it can affect your option trading strategy.

In addition to weekly options, the CME introduced “Wednesday Weekly Options on Futures”. These options will offer mid-week expiry, as opposed to end-of-week expiry, with the objective of providing traders with even more flexibility in their trading strategies. At the time of this publication, the Wednesday weekly options are only available on the pit-traded S&P 500 contact and the e-mini S&P 500 contract.

Weekly options present a great opportunity for speculators in that there is little time premium to pay for, so at or near the money options are affordable, as shown above, and your risk is defined if you are a buyer of the option. For example, instead of entering a futures contract and placing a stop a trader can buy a close to the money option that will keep you in the trade in the market versus having a stop triggered and being taken out of your trade. This is beneficial for traders who look to capitalize on volatility on economic reports like, retail sales, durable goods, FED announcements and monthly job reports. Aside from a speculative stand point weekly options are also great to use for hedging purposes while paying little for time value.

Advantages of Weekly Options

Similar to traditional options, each individual weekly option will identified as either a put or a call, state a given strike prices, and also

include which week they are to expire in. For example, an “end of week three September 2016 E-mini S&P 500 2100 call option” would expire on Friday of the third week in September and would be delivered against the September 2016 (U’16) futures contract at expiration. Weekly options are available for weeks 1-4 in every contract month which translates to numerous trading and/or hedging opportunities for traders like you. The introduction of weekly options has allowed traders to implement innovative and creative trading strategies in an effort to both realize positive returns, as well as mitigate risk.

Consider a situation in which a trader has a short position in the Dec’16 E-mini S&P 500 futures contract and the market is currently trading at 2100.00 at the close on Wednesday. There is a significant GDP report that is scheduled to be released at 7:30am CST the following day and the preliminary expectation is for Real GDP to come in at 1.1%. Having done your due diligence, you anticipate the GDP figure to come in at 1.3%, well above market expectations. Given your positive outlook on the upcoming GDP figure, you are concerned that the market may see a near- term rally off the report. A trader could partially hedge the upside risk that he may expose himself to on his short futures contract by purchasing Oct’16 end of week 1 2100 call options that expires at the close the following day (first Friday of October). With this strategy, the participant would be “protected” in the event that the market rallies against his futures position. In the event that the report comes out bearish and the market sells off, the participants’ options will likely expire worthless and he or she will lose the amount of premium paid for the options, which would equate to the “cost” of the hedge. The introduction of weekly options has made strategies like the one described above possible, whereas traditional options are typically less effective in managing such risk due to the relatively infrequent expiration dates.

Aside from event-driven volatility hedges, weekly options on futures can allow participants to hedge against anticipated adverse directional movements of a longer term position. Say that you have established a long-term position in the futures market which you intend to hold for several years. After having done your homework on the trade, you expect prices of crude oil futures to appreciate over the next 6-12 months. Three months have passed and the oil market has appreciated 10% since you initiated the position… not bad!

Unfortunately, one of the major oil producing countries recently announced that they intend to double their oil production over the next 4-6 weeks in an effort to satisfy demand if indeed oil production is ramped up; however, you don’t want to completely liquidate your position in the event that oil continues to appreciate in price despite the recent news. Through the use of weekly options, you could take a long position in at-the-money weekly put options throughout the period in question to “hedge” your longer-term long oil position.

In the event that the market declines to your strike price, the idea is that the money made on the long weekly put options will go to offset the unrealized losses incurred on your long futures position. After the production increase has been phased out, you anticipate oil prices will rise and you no longer have a need to continue buying weekly puts to protect your long position against an adverse move in prices. The number of ways to implement weekly options into your trading strategies are endless!

Aside from the additional expiration dates and flexibility that weekly options provide traders, these products also allows clients to trade with the timeliness and precision that may not be available through the use of standard options, which traditionally only have one expiration date per month. With that being said, participants do need to realize that, given the short duration of weekly options, time premiums can be magnified and, should you find yourself holding an out- of- the-money option, time decay can depreciate the value of that option at an accelerated pace.

Markets Currently Offering Weekly Options

As a result of the increased demand of weekly options, we’ve seen a tremendous increase in the number of weekly options that are available to trade. At the time of this publication, the following markets have weekly options that are tradable through the CME:

Equity Index

- E-mini S&P

- E-mini Nasdaq

- E-mini Down

Metals

- Gold

- Silver

- Copper

Energy

- WTI Crude Oil

- Brent Crude Oil

- Natural Gas (Physical)

Interest Rates

- Ultra T-Bond

- 30-Year T-Bond

- 10-Year T-Note

- 5-Year T-Note

- 2-Year T-Note

Grains

- Corn

- Wheat

- Soybeans

- Soybean Meal

- Soybean Oil

Any weekly option shall be designated to expire on a given Friday, provided that no weekly option shall be designated to expire on any Friday that is also the last day of trading in a standard or serial option (Rule 10A01.I.1). Trading in any weekly option shall terminate on the Friday on which such option is designated to expire. If such Friday is not a business day, then trading in weekly options designated for expiration on such Friday shall terminate on the business day prior to such Friday.

Before trading any futures or options product, you should always check the volume and open interest for the specific contract in question to ensure sufficient liquidity to trade the product. Since weekly options on futures are relatively new products, there is a chance that some of the specific strikes/dates may be less liquid than others. We encourage you to contact one of our Market Strategist here at RJO Futures to ensure adequate liquidity before trading these products.