Trading commodities can provide a lucrative income and each year that a person trades, he or she must complete a tax form claiming any profits. The 1099-B form is used for listing this information. This guide by RJO Futures provides insight into filing taxes on commodities trading. What is commodity tax? When profits are made on trading hard assets, they are subject to a special tax. A commodities tax is placed on those profits per the 60/40 tax rule:

How are Futures Trading Profits Taxed?

In the United States, futures contracts are subject to the 60/40 rule. This advantageous tax treatment also applies to day trades and is broken down into two parts:

- 60% profits – taxed as long-term capital gains

- 40% profits – taxed as short-term capital gains

What this means is that 60% of the gains are subject to the long-term capital gains rate which is 15%, while 40% of the gains are subject to the short-term rate of 35%. Some critics feel that the 60/40 rule tends to be too arbitrary, particularly when compared to stocks, which are taxed at the short-term capital gains rate of 35%. However, there has not been enough of a push to do away with it for any action to be taken that would end it.

How are futures trading losses handled?

Under IRS rules, a futures trader is considered an investor unless he or she makes their living trading futures. As an investor, losses are treated the same as capital losses. The IRS also identifies some people as traders if they meet specific criteria. They are able to choose to treat their losses as ordinary. Both traders and investors have the option of choosing a tax treatment called mixed straddle election. This can lower the taxes that are due as well as simplify tax reporting.

The three most common ways that losses are handled include:

Capital Losses

Capital losses are taxed per specific rules set forth by the Internal Revenue Service (IRS). When something of value is sold for less than the purchase price, it is considered to be a capital loss. Capital losses can be used to offset Capital gains which can result in a reduction in the overall tax obligation. Excess capital losses can be deducted against an ordinary income amount of $3,000 per year. Any unused long and short capital losses can be carried into future years.

Ordinary Losses

Ordinary losses can be deducted up to the amount of the trader’s full income. The excess can be carried forward to future years.

Mixed Straddle Election

Traders and investors can classify their net capital gains by using the 60/40 rule. This also means that traders and investors are not required to maintain exact records on each individual trade, beyond loss or gain. The trader’s or investor’s adjusted gross income is used to determine the long term capital gains. Net capital gains are calculated following this formula:

- Trading Gains – Losses (subtract losses from trading gains)

Under the 60/40 rule, taxes that traders and investors pay is based on their income.

- Long term capital (60% of the gain)

- 10% to 15% tax bracket is 0%

- 25% to 35% tax bracket is 15%

- 36.9% tax bracket is 20%

- Short term capital (40% of the gain)

- Normal income tax rate

How do you report futures contracts on your tax return?

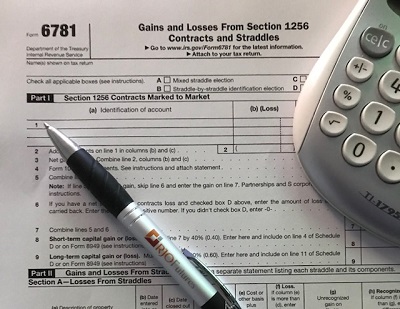

The IRS makes available a specific form that is to be used for reporting gains and losses from straddles or financial contracts. Form 6781 is used to report Section 1256 Contract investment gains and losses. A Section 1256 Contract is a type of investment that the Internal Revenue Code (IRC) defines as a regulated futures contract, foreign currency contract, non-equity option, dealer equity option or dealer securities futures contract. At the end of the tax year, the specific contracts that the taxpayer holds are treated as if they were sold for their fair market value. The losses or gains are treated like long term or short-term capital gains. The IRC falls under the purview of the IRS.

Common mistakes traders make when filing

The United States tax code is extremely complex with nearly 75,000 pages and more than 2,000 tax forms and publications. Mistakes are bound to happen, especially to people who have limited exposure or understanding of it. However, that does not mean that a person can’t get into trouble for their mistakes. Here are the most common and how to avoid them.

- Using Schedule C to report losses and gains. According to IRS code, Schedule D is the form that must be used for reporting all capital transactions.

- Failing to file because they did not trade very much or experienced trading losses. Just because a person does not have trading profits it doesn’t mean that they don’t have to file a tax return. This is not true and people who fail to file may be subject to penalties, notices, and interest from the IRS.

- The traders go to an IRS audit without any representation. Anytime a trader is called in for an audit, he or she should never attempt to go it alone. It is not in the person’s best interest to attempt to represent themselves when they go before the IRS.

- Self-employment taxes paid on trading. Trading income is not viewed by the IRS as earned income. Only earned income can be included in the self-employment tax. However, many traders mistakenly believe that because they are trading via a partnership, corporation, or LLC, that their gains can be counted as earned income.

- Becoming confused by the tax treatment between securities, forex, 1256 contracts, and options. Futures contracts fall under Section 1256 and receive the tax treatment the 60/40 split. It is vital that this information is reported correctly.

- Failing to have a clear and viable tax strategy. Traders can save money, reduce their tax liability, and build wealth faster with a solid, clear tax strategy.

- Failing to claim trader tax status properly – or at all. Using the business expense treatment can save business traders at least $5,000. This allows them to claim deductions for their home office, startup costs. And education.

Contact RJO Futures for all your trading needs. Give us a call and talk to one of our friendly representatives or give us a call and find out what really sets us apart from other brokerages.

NOTE: This material is not to be considered tax advice. Please consult a professional tax advisor if you have any tax related questions.