The goal of this article below is to give a broad introduction to the world of E-mini futures. In this piece, you will find out what E-mini futures are and why they are so enticing to traders. We will discuss the basics of E-mini futures such as: what they are, how to trade E-mini contracts, where to trade E-mini futures, E-mini futures trading strategies and much more. We hope you will find this reading informative.

Traders looking for new market alternatives should consider the advantages of thinking small. Using the electronically traded E-mini S&P 500 has become more popular in recent times than its big brother, the S&P 500 futures contract. E-mini S&P 500 contracts are referred to “E-mini” because they are only 1/5 the size of normal S&P 500 contracts. The term “E-mini” can refer to many U.S. stock markets, however, the E-mini S&P 500 contract is the most popular and will be the focus of this article. Other futures contracts that offer an E-mini version are:

- S&P Midcap 400 (symbol EMD)

- S&P Smallcap 600 (symbol SMC)

- NASDAQ 100 (symbol NQ, 100 largest NASDAQ companies)

- NASDAQ Composite (symbol QN, all 3,000+ NASDAQ companies)

- NASDAQ Biotech (symbol BQ)

- Dow (symbol YM, traded on CBOT exchange)

- Russell 2000 (symbol TF, traded on NYBOT/ICE exchange, small cap index, formerly ER2 on CME)

- Russell 1000 (symbol RF2, traded on NYBOT/ICE exchange, large cap index, formerly RS on CME)

- Metals and commodities such as Copper, Gold, Silver, Corn, Wheat, Soybeans, Natural Gas, Crude Oil, Heating Oil and Unleaded Gasoline

- Forex rates versus the US Dollar such as Euro, British Pound, Swiss Franc, Japanese Yen, Australian Dollar, Canadian Dollar and Chinese Renminbi

What Are E-mini S&P 500 Futures?

E-mini S&P 500 futures are a mini version (1/5th the size) of S&P 500 futures contracts and are traded on the CME. E-minis were launched in 1998 and are now the most popularly traded index futures in the world. Introduced in 1998, the E-mini S&P 500 futures (ES Futures) is equivalent to 500 shares of the S&P 500 index and is traded on the Chicago Mercantile Exchange via CME’s GLOBEX platform. Although traders speculating on the futures prices of the underlying stocks or the index as a whole account for the lion’s share of trading volume, the E-mini can also be used as a tool to protect downside risk by hedging market exposure.

For example, if you have a well-diversified stock portfolio and are concerned that a market correction is imminent, you have two options available to you. Firstly, you could close out all open trades and ride out the market correction with no risk to your capital. Or you could hedge your position by selling the E-mini S&P 500 enabling you to balance out your risk whilst still having the potential to earn dividends on the cash equities in your portfolio. Of course, you would need to balance out the number of futures contracts traded with the total value of your portfolio. If the market does decline, then your short futures position may yield profits to offset losses on your stock portfolio. And if the market rallies, the futures position may produce losses that can be offset by the appreciation of your stock portfolio.

How to Trade E-mini S&P 500 Futures

The first step to trading E-mini futures is having a funded futures account. A futures account is not the same as a stock trading account because it is run with different regulations. RJO Futures offers different types of futures accounts from self-directed, full-service, and managed futures accounts to suit your trading needs. Once you have a funded account you need to start tracking the market and develop a trading strategy or consult with a futures broker to help guide you. Once you have established some chart tracking and an E-mini futures trading strategy, you are ready to place and order. This can be done through a broker or through your chosen trading platform. You can choose the type of order you want, like “at market” (current market asking price) or a “limit order” (a price you nominate, the contract will be purchased if/when the market hits this price). Congratulations, you are now an E-mini trader.

E-mini S&P 500 Futures Trading Strategies

A well-proven E-mini futures trading strategy is a prerequisite for all traders, whatever type they are, or the market they trade. And this also applies when trading the E-mini S&P 500 Futures. A trading strategy is simply a set of rules that are defined in advance. The trader should abide by all the strategy rules before a trade is placed. A good S&P 500 E-mini trading strategy includes the ingredients and the instructions – the recipe – on how to place a flawless trade. A good E-mini trading strategy also helps define and trade the market characteristics that re-occur frequently, so there is a higher probability of success.

It is crucial to understand that a trading strategy and technical analysis (TA), are not the same things. However, TA is a major component of any strategy. The list of TA tools is lengthy. They include: trend analysis, moving averages (MAs), candlestick patterns, support & resistance, Indicators – convergence and divergence – and multiple timeframe analysis. For example, intraday futures traders could include market internals as a key piece of information in their trading strategy. But while TA is a large part of any strategy, there are other vital ingredients that should also be included. You cannot trade successfully on TA alone. And an intrinsic part of any strategy is a robust risk management plan.

Trend Gap Strategy

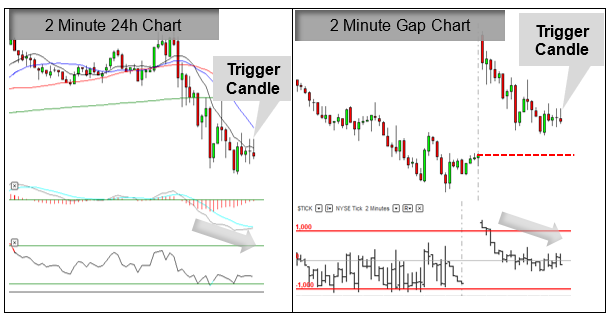

There are many good trading strategies that lend themselves well to the E-mini S&P. A trend gap strategy is one that is well suited to intraday trading the shorter timeframes, and to scalping trading. The trend gap E-mini strategy buys and sells pullbacks into smooth flowing trending markets. It uses candles to identify the precise trade entry and stop, and it utilizes the NYSE $TICK indicator as an additional indication of market momentum and direction. The opening gaps are used to anticipate initial market direction.

Trend Gap Strategy Rules

There should be a trending price action with the E-mini S&P making clear higher highs and higher lows for an uptrend and lower highs, and lower lows for a downtrend. Having a directional bias is the first key piece of information for a trade setup. This trend would then need to be confirmed by analyzing four moving averages (MAs). For example, in an uptrend, the shorter-term10MA and 20MA, the medium-term 50MA, and the long-term 200MA, should be fanning out and in order. The 10MA and 20MA are also useful to time an entry as price pulls back to them, as per figure 1 below. The trade entry would be taken on a small candle and the trade should be in the direction of the opening market gap.

Identify the Gap

A gap in the charts is displayed as an empty space between the close of one candlestick and the opening of the next. Gaps are more common in the Futures markets and hence the reason the gap strategy is used by many Futures traders.

Gaps can provide a trading edge, but they shouldn’t be used as the only reason to enter a trade. However, combined with other reliable TA, they can be useful as they are easy to identify and offer a target – the gap close.

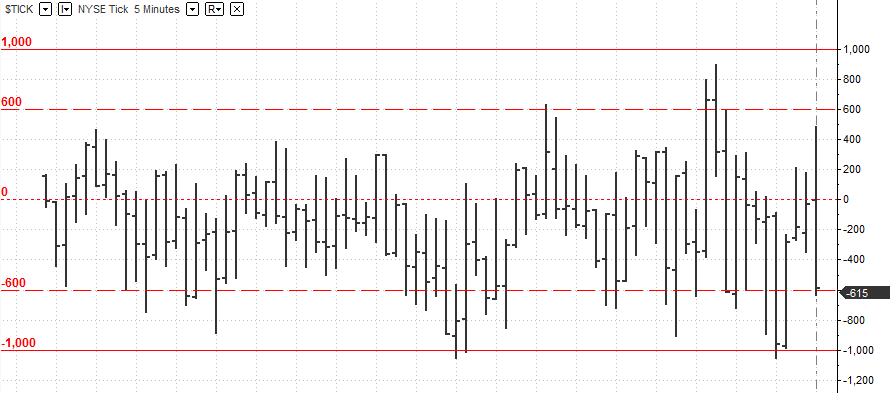

$TICK Indicator

The $TICK can be used as an additional momentum direction indicator. When the $TICK hits an extreme reading, this can be interpreted as a contrarian indicator, because when there are too many buyers or sellers the market tends to correct to find balance. Or, if a trend forms within the $TICK reading, this can indicate continuation.

Gap Strategy Example

The rules of this E-mini futures trading strategy are simple. Considering the two chart examples below, which represent the 24-hour continuous contract and the gap chart of the E-mini, we can check:

- Is there a trending price action making clear higher highs and higher lows for an uptrend, or lower highs and lower lows for a downtrend? Yes, we can see the 2-min timeframe on the 24-hour chart is trending down, so we have a downtrend.

- Is the trend confirmed by analyzing four MAs? Yes, the MAs are coming into alignment with the 10MA below the 20MA which is below the 50MA.

- Is there a small candle? Yes, a small bearish candle has just formed.

- Are the indicators converging with price to the downside? Yes, MACD is trending lower with price. In addition, $TICK has been trending lower since the market opened, so it is also complying with the Gap Strategy rules.

The entry would be 1 tick below the low of the trigger candle and the stop would be 1 tick above the high of the trigger candle. The target is the gap close. Finally, refer to your risk management plan and only use a certain percentage of your capital per each trade. As noted above, robust risk management is essential.

Conclusion

The best E-mini S&P 500 trading strategies are combinations of traditional TA tools, market internals and risk and money management techniques. The trend gap strategy is a union of complementary tools that is not only simple to execute, but effective for the modern day trader.

Reasons to Trade E-mini S&P 500 Futures

One reason to trade the E-mini S&P 500 futures contract is that it is an affordable and easy way to gain exposure to one of the most popularly traded futures contracts on the market . The reduced size of the E-mini S&P 500 futures contract traders to maintain great leverage and liquidity, usually reserved for much larger futures contracts, over the S&P 500. It makes these benefits accessible to the smaller retail traders who normally wouldn’t have the capital to trade full futures contracts. Essentially, the E-mini contract is the best of both worlds.

Another reason to trade the E-mini S&P 500 is it offers greater capital efficiency compared to other options like ETFs. If the full value of the E-mini S&P contract is $205,000, the trader is only required to put up 4.7% total cash value, which would equate to $9,635 per contract. In essence, an E-mini trader is controlling over 200k worth of the S&P 500 for an initial margin just shy of 10k, providing them with efficiency and leverage that an ETF cannot.

E-mini S&P 500 Futures Contract Specifications

The E-mini contract is denoted by the “ES” ticker symbol, plus a code for expiration month and year. The contract expires every quarter on the 3rd Friday of March, June, September and December with each expiration month denoted by an “H”, “M”, “U” and “Z” respectively. Before the current contract expires, trading rolls over into the next quarter’s contract on the rollover date, which is the 2nd Thursday of March, June, September and December (when the rollover month starts on a Friday, rollover will occur on the 1st Thursday of that month).

Of the two dates; rollover and expiry, the more important one to be aware of is the rollover date as the majority of trading, hence volume and liquidity, moves to the next contract. It is advisable to keep a calendar of these rollover dates to ensure you remain current.

Contract Specifications:

The E-mini is cash-settled to the S&P 500 index on quarterly expirations and settled daily to the standard sized S&P 500 contracts’ counterpart settlement price.

E-mini Ticks

A tick is the measurement of upward or downward movement in the price of a security or contracts. A 1-point movement in the S&P 500 index is worth $50 per E-mini contract. An E-mini “tick” is measured at .25 index points. So, a one tick movement, up or down, in an ES contract is work $12.50.

E-mini S&P 500 Trading Hours

Trading is available 23.75 hours a day, 5 days a week, with the CME coming online on Sunday at 5:00 pm (CST) and closing again on Friday at 4:00 pm. Each afternoon, Monday through Thursday, there is a brief halt in trading from 3:15 pm to 3:30 pm.

Margins

The initial margin requirement on E-mini S&P 500 futures contracts is $5,060 with a maintenance margin of $4,600. The overnight initial minimum is another thing to take into consideration when trading E-minis. This is the amount of money needed to hold your position in the market after close. Both the initial and overnight margins can fluctuate at any moment-based market volatility.

In a bid to limit the amount of margin calls occurring during periods of extreme volatility, the CME implements price limits for the E-mini. These price limits are considered by many to be a useful step to halt trading during a market crash and is known as a “circuit breaker”.

Outside of US market hours (5:00 pm to 8:30 am CST), the up and down price limits are set at 5% of the latest reference price of the contract. During market hours (8:30 am to 3:00 pm CST), the limit down price is set at 7%, 13%, and 20%.

Affordability of Trading E-mini over ETFs

The E-mini offers greater capital efficiency compared to using Exchange Traded Funds (ETFs) or a basket of securities. This efficiency is one of the primary reasons that this index future has been so successful. For example, the full cash value of the E-mini is equal to the S&P 500 index price * $50. In other words, if the E-mini is trading at 2,380.00, the full cash value would be $119,000/ contract (2,380.00 * $50.00).

Therefore, a trader would be able to hold $119,000 worth of stock for only $5,060/contract (initial margin) or 4.7% of the full cash value. Additionally, most FCMs will allow you to day trade using 50% of the overnight margin requirement, depending on your suitability for trading.

Global Forces Affecting the E-mini S&P 500 Futures

Global events such as major economic reports in other nations, particularly those that import and export U.S. goods, also have a major impact on E-mini. The overnight GLOBEX market tends to be sluggish, while the Asian and European trading sessions are in progress with the E-mini often moving in sympathy with these foreign markets. If major news comes out of any of these other regions causing the foreign markets to become volatile, then the E-mini will most often respond by becoming volatile with volume increasing to abnormally high levels for that time of day.

Most European economic news is announced between 3am and 4am CST and is almost always a market moving event, and it often pays to watch the markets for reactions to European news. Non-data examples of major effects on the E-mini are Britain’s exit from the European Union (Brexit) and the effect of U.S. 2016 U.S. presidential election. The equity markets have made new highs, rallying for over 100 days without a 1 % decline, on the expectation that the new government will lower tax burdens on corporate America to spur revenues and growth.

Benefits of Trading E-mini S&P 500 Futures Contracts

- As it is based on an index that is in turn based on a large basket of stocks, individual stock news, earnings, price gaps, dividend payments, IPOs

etc. do not have a major effect on its price - Trading is regulated with all trades being required to follow CME clearing rules as well as the CFTC and NFA rules.

- It’s a fully electronic market with all market participants (including market makers) having access to a Level II data as well as bid/ask spreads; in other words, it’s a level playing field.

- Great market depth and liquidity allows for rapid online order execution with minimal slippage and makes it difficult to manipulate by large players.

- No up-tick rule.

- The large amount of algorithm trading also prevents the E-mini from major selloff events or covering rallies

- The E-mini can exhibit smooth and predictable trends for extended periods

- 24-hour trading making the E-mini an attractive investment for traders around the globe.

What are Micro E-mini Futures?

In May 2019, The CME launched micro E-mini futures contracts and the new contract wasted no time in sky-rocketing up the charts. Micro E-mini contracts are traded at 1/10th the size of a normal E-mini contract, making it much more accessible to small time traders and an option to a much larger scale of people. For example, to purchase a full E-mini contract you need a margin of $4,250, but to purchase a micro E-mini contract you only need $425, which creates a much more enticing option to those with less trading capital. This accessibility led to the micro e-mini becoming the most successful product launch in the history of the CME, selling 11.25 million futures contracts in its first month available.

In addition to its accessibility, the micro E-mini also boasts many of the same benefits a full-size E-mini does, including, a nearly 24-hour long trading period, no management fees, liquidity, and the ability to convert each contract into a full-size e-mini.

Conclusion

The E-mini S&P 500 futures market has become the world’s most popular futures market for good reasons. It provides low margin entry into a highly liquid and cash-efficient global market. Traders can get into E-mini index futures for approximately 5% of the full cash value of the underlying stocks. The market is easy to access through the CME GLOBEX electronic platform and is open almost 24-hours a day, 5 days a week. The E-mini is a tax efficient way for traders to diversify their investment portfolio, hedge market exposer and conveniently manage global equity exposure through one marketplace.