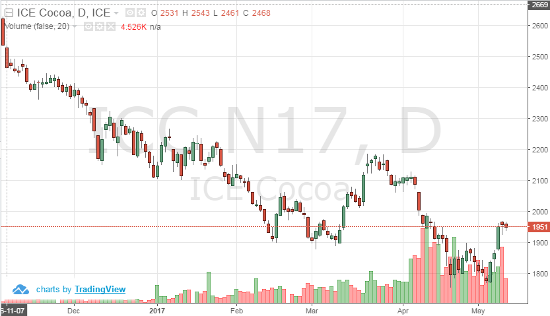

We continue to hear that cocoa production numbers are up from recent years causing the market to find a new, lower trading range – but now there are concerns about the quality of the crop. Black pod disease is being reported in southwestern Nigeria. Weather patterns have damaged key growing regions and output. Although there was an abundance of cocoa to start the year; weather, port shutdowns – bottlenecking at output areas and black pod are giving traders a new market to look at. In the past 3 trading days, July cocoa has comeback about 10%. The market had seen oversold levels and buyers attempted to find a bottom. 1775 held and the market is deciding what to do at 1950 now. There is resistance here so the market will need more fundamental bullish news to break and hold above this area. In the short-term, look at weather patterns, supply and demand data and Cocobod borrowing issues to guide the market.

Jul ’17 Cocoa Daily Chart