Spread trading is a highly-useful strategy that allows traders to simultaneously buy one contract or market and sell a related one. By reading our curated archive of spread trading material, you can learn the key differences between intramarket and intermarket spreads, and other key information that’s necessary for informed trading.

Spread Trading

Introduction to Spread Trading

Learn the basics of trading spreads, which can conserve capital and provide a steady way to participate in the markets. Learn about everything from intermarket and intercommodity spreads to intracrop spreads. It’s all here! This method is perfect for traders who like to minimize risk and appreciate the slow and steady approach.

Commodity Spread Trading Strategies

Spread trading involves taking opposite positions in the same or related markets. A spread trader always wants the long side of the spread to increase in value relative to the short side. This means the spread trader wants the difference between the spread to become more positive over time. Whenever a spread is quoted, it’s always a single price. You would never get a quote with the two individual prices.

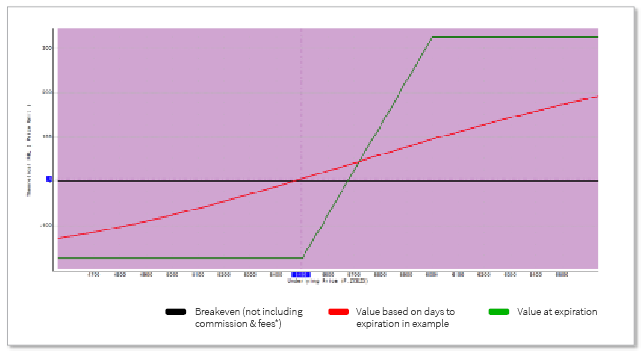

Trading Options: Bull Call Spread

A bullish call spread option, also known as a bull call spread option, is a trading strategy that aims to capitalize in an increase in the price of a given market or asset. The bull call spread option strategy consists of two call options that create a range that outlines a lower strike point and an upper strike point.

Here, we provide a brief overview of pairs trading. Pairs trading, also known as Statistical Arbitrage Trading is defined as trading one financial instrument or basket of financial instruments against a second financial instrument or basket of financial instruments: long one and short the other.

Learn how spread trading can be another tool in your futures trading plan.