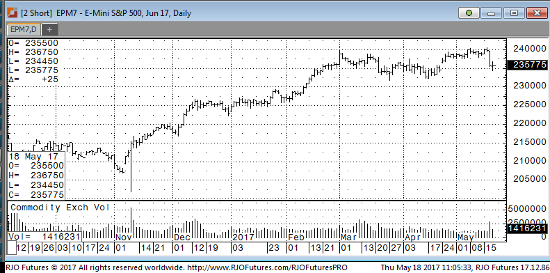

Global markets remained under pressure in a reaction that more than likely followed the slide seen in the US markets on Wednesday. However, with US stocks showing renewed pressure again this morning, the spiral looks to continue throughout the world. Clearly, the markets were not supported in the face of mostly positive international scheduled economic data flows overnight. With US data scheduled later this morning projected to be soft, and the Washington political rumor mill running at a very high RPM again, there is no reason to call for an end to the selling carnage. While there might be some positive news flowing from corporate earnings due out today, news from earlier in the week that Ford was cutting jobs combined with news this morning that GM will cut facilities in India and South Africa simply adds to the bear case. With another range down extension in the June e-mini S&P to start, there might be little in the way of support until 234050. As indicated already, US scheduled data due out later today could facilitate even more declines. In fact, with June e-mini S&P overnight retesting its 50 day moving average at 236500 and then falling back away from that test, it is clear that investors and traders lack resolve. It should also be noted that the June e-mini S&P has fallen below a four month old uptrend channel support like at 2351.

Emini S&P 500 Daily Chart