Last weekend, I walked right past the meat cooler at our local warehouse grocer because the steak prices were higher than I wanted to pay. This weekend I looked for the oversize package of choice meat, and the case was empty. Supply is still tight and weights are still low, though steadily increasing. Last week’s COT report reflected a large percentage of cattle being placed over 700 lbs which continues to support the idea weights will continue to increase in the over 120 days category in the feedlots. This supply is expected to weigh down the market come August and through October and the spreads reflect it. This morning’s Daily Livestock Report (DailyLivestockReport.com) stated:

“…head placed into U.S. monthly reported feedlots during the first four months of this year was the largest since January-April of 2000.”

Last week cash traded 132-133 and June futures averaged about $10 lower. The wide basis still favors the bulls into the end of June and seasonally bull spreads have a good track record of success from early June into the end of July although these spreads have been trading at lofty levels since the beginning of May. Look for June futures and the cash market to find a happy medium in the upper 120s.

COT data last week showed non-commercials at a record long and non-reportables short a relatively large percentage short relecting a large stubborn long by funds and active hedging by small to medium size operators.

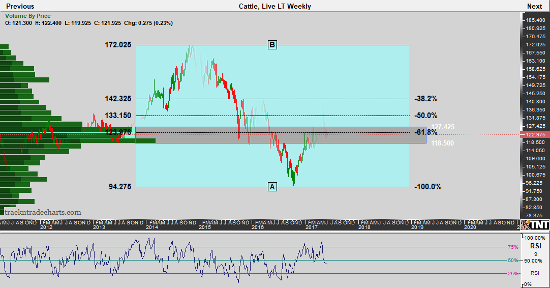

The live cattle futures charts remain bullish, but short-term levels are in a whip-saw trade between the 119-127 weekly value range (see chart below). RJO Market Insight’s Dave Toth identifies the 116.775 in August and 118.625 end of day for LT bulls to use as a line in the sand.

Several EW analysts interpret the current formation in a potential wave 5 targeting new highs. This would support a futures/cash convergence into the end of June and wave 5 completion.

Moving forward, cash is still favoring the bulls but the product market and the charts appear to be fairly priced, so the path of least resistance maybe two sided. Take advantage of overbought/oversold 3-day advances for entry or exits.

Live Cattle Weekly Chart

Source: TrackN’Trade