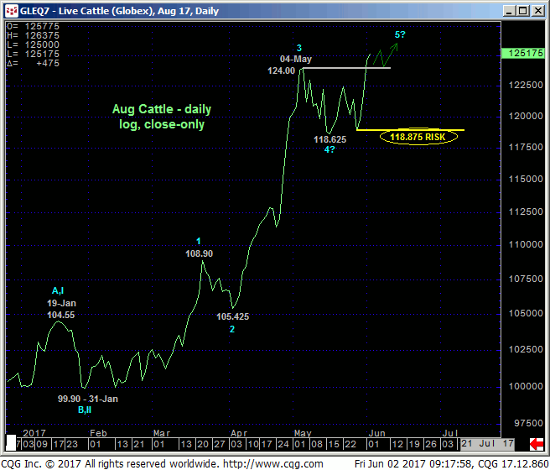

In 04-May’s Technical Blog we following one of the more extended bull trends this (or any) market has seen in a while, we emphasized the prospect that such a roaring bull had to “slow down” before it could ultimately peak out. Dow theorists might call such a process the left-shoulder of an eventual head-and-shoulders peak/reversal pattern. Elliott geeks call it a 4th-wave. The technical “language” doesn’t matter as it’s all the same stuff. What matters is that the barreling northbound freight train show proof of slowing down before it can throw it into reverse. This is exactly what has transpired with the corrective (4th-wave) setback from 04-May’s 127.50 high to 16-May’s 116.775 low detailed in the hourly chart below.

We discussed the likely end of the correction and resumed broader bull in 25-May’s Technical Blog following 22-May’s recovery above 15-May’s 122.425 corrective high that, in fact, stemmed the early-May sell-off attempt. Yesterday’s break above 22-May’s 123.15 initial counter-trend high reaffirms the uptrend and, most importantly, leaves 30-May’s 117.95 low in its wake as, we believe, this market’s single most important technical level heading forward. For it is this corrective low exactly that the market needs to sustain gains above to maintain a broader bullish count. Its failure to do so will, in fact, break the major uptrend and expose a peak/reversal environment that could be major in scope. Until such sub-117.95 weakness is shown the trend is up on all scales and should not surprise by its continuance or acceleration.

While the daily log scale chart above shows the market still below 04-May’s 127.50 intra-day high, yesterday’s 124.70 close exceeded 04-May’s 124.00 high close. For all intents and purposes then, the expected 5th-Wave “gasp” to a new high has been satisfied. This by no means means we can conclude a top. Indeed, there may be major gains yet to be realized. But by at least achieving a “new high” we can now look at ANY bearish divergence in momentum- even a minor scale one- as a threat to the major bull.

The fact that bullish sentiment remains historically frothy is a key warning flag of a peak/reversal-threat that could be major in scope. Traders are reminded however that sentiment is not an applicable technical tool in the absence of a confirmed bearish divergence in momentum needed to, in fact, break the clear and present uptrend. Herein lies THE importance of identifying a corrective low and risk parameter like 117.95 .

This weekly chart also shows an “outside week up” this week (lower low, higher high and higher closed than last week’s range and close) that would seem to reinforce a broader bullish count.

These issues considered, a bullish policy remains advised with a failure below 117.95 required to not only negate this count, but also expose a peak/reversal environment that could be major in scope. IF IF IF the market is in a completing-5th-wave-mode, it should be characterized by waning momentum on an intra-day hourly basis and increasingly frustrating price action higher (i.e. make a minor new high and fail and then another new high and fail). But until the market fails below 117.95, setback attempts to, say, the 123.00-area OB are advised to first be approached as corrective buying opportunities.