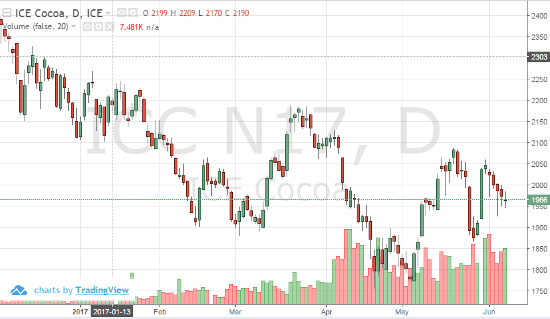

The continued talk of a large production surplus controls the market. After a short-term rally higher, prices sold-off for four sessions. Estimates are coming in for processing. Demand is stagnate and a non-factor. A move lower may attract buyers back into the market, especially institutional and commercial traders. Technically support is at 1950 and 1910. The gain on May 30 has not been completely erased so we’ll see what the remainder of the week brings us. Consolidation at these levels could lead to a range bound trade between 1965 and 1905 if the fundamental outlook doesn’t change. Weather premium is something to watch. For now, the production surplus is the main story but may finally be priced in for the season.

Jul ’17 Cocoa Daily Chart