While we discussed the slippery risk/reward slope for bullish exposure in yesterday’s Trading Strategies Blog in which we advised taking profits on longs from 1.2850, even we were a little surprised at the extent of overnight’s spasm to the lower-1.26-handle. The past couple days’ waning upside momentum and eventual confirmed mo failure clearly defines yesterday’s 1.2979 high as one of technical merit and our new short-term risk parameter the market is now obligated to recoup to resurrect our long-term bullish count. However….

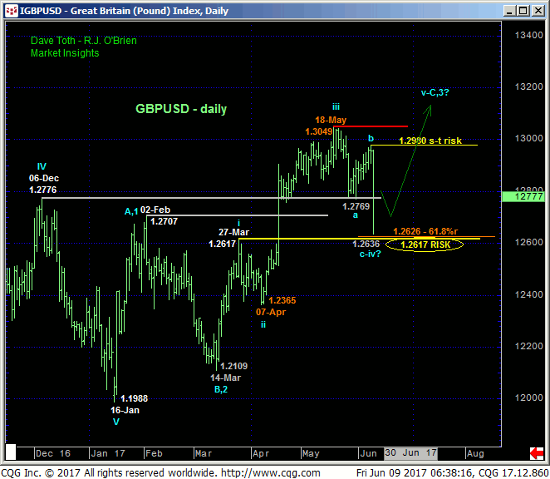

From a longer-term perspective overnight’s plunge has thus far held the key area of former resistance ranging from 06Dec16’s 1.2776 high to 27-Mar’s 1.2617 (1st-Wave) high and our long-term risk parameter as new support. Overnight’s 1.2636 low was just 10-pips from the (1.2626) 61.8% retrace of 07-Apr-to-18-May’s suspected 3rd-Wave rally from 1.2365 to 1.3049 labeled in the daily chart above.

TO THIS POINT the sell-off attempt from 18-May’s 1.3049 high is clearly “only” a 3-wave affair. Left unaltered by a relapse below today’s 1.2626 low, this 3-wave setback may be considered a corrective/consolidative affair well within the bounds of this year’s still-arguable major developing uptrend. In this regard longer-term players remain advised to maintain a bullish policy with a failure below basically 1.2600 required to threaten or negate this call enough to warrant moving to the sidelines.

On the heels of overnight’s plunge we will be watchful for proof of 3-wave, corrective behavior on relapse attempts from a short-term perspective in the days immediately ahead as, if our longer-term bullish count is still unfolding, the past three week’s corrective adjustment may be just the pause that refreshes to provide another very favorable risk/reward opportunity from the bull side for shorter-term traders.

In sum, a bullish policy remains advised for long-term players with a failure below 1.2600 required to move to the sidelines. A neutral/sideline policy is advised for shorter-term traders for the time being.