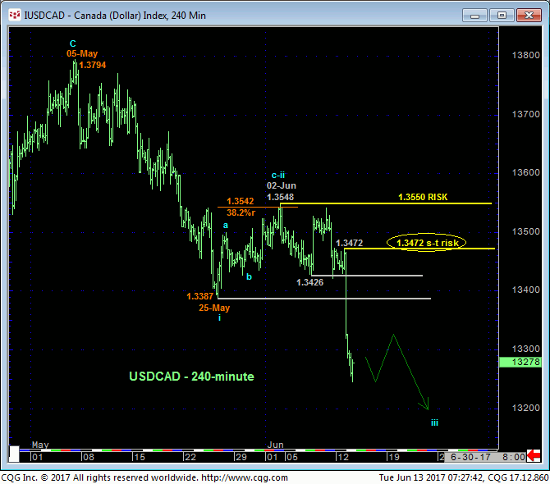

Yesterday and overnight’s collapse below 25-May’s 1.3387 low reaffirms our longer-term bearish count most recently updated in 06-Jun’s Technical Blog and leaves smaller- and larger-degree corrective highs in its wake at 1.3472 and 1.3548 that now serve as our new short- and longer-term risk parameters from which a still-advised bearish policy and exposure can be objectively rebased and managed. Former 1.3387-to-1.3426-range support is considered new near-term resistance ahead of further and possibly steep losses.

Integral to our longer-term bearish count is the fact that our proprietary RJO Bullish Sentiment Index of the hot Managed Money positions reportable to the CFTC has ACTUALLY FALLEN FURTHER over the past month’s USD decline and CAD rally. Such historically extreme bearish sentiment and exposure by the managed money community is now ripe for the market’s forced capitulation which will only contribute to the USD’s decline.

How much of a USD-decline is anyone’s guess. But given the prospect that the entire YEAR’S recovery from May’16’s 1.2460 low to May’17’s 1.3794 high is a 3-wave and thus corrective affair as labeled in the weekly chart below, a resumption of Jan-May’16’s downtrend to new lows below 1.2460 is as viable a call as any. Moreover, if such a count is correct, we would expect this resumed downtrend to behave as impulsively as that early-2016 decline did. A similar decline (i.e. a 1.000 progression) from 05May17’s 1.3794 high would project to the 1.1563-area over the next three months.

Are we forecasting such a meltdown? No. But until and unless this market proves strength above at least 1.3472, no amount of USD-collapse should come as a surprise, including a rout to the 1.15-handle. Per such, a full and aggressive bearish policy and exposure remain advised with a recovery above 1.3472 required to move to the sidelines.