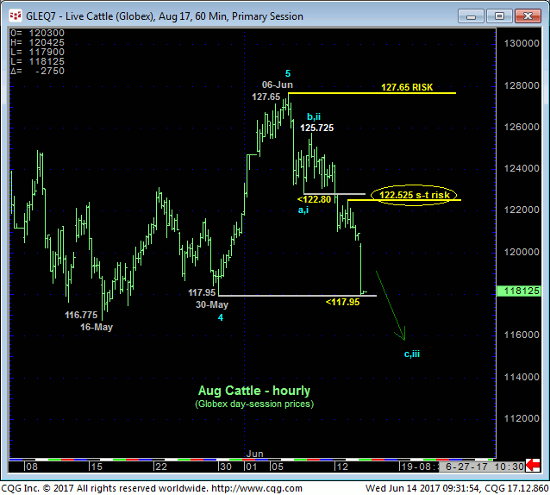

In Mon’s Technical Blog we discussed an admittedly short-term mo failure below 122.80 that, considering mounting threats against the bull, could be taken as an early indication that the 8-month bull may have expired. However, further and commensurately larger-degree weakness below 30-May’s next larger-degree corrective low at 117.95 remained required to confirm a bearish divergence in momentum of a SCALE SUFFICIENT to break the major uptrend. This morning’s accelerated break below that 117.95 has confirmed this divergence and exposed a correction or reversal lower that could be major in scope.

As a direct result of today’s continued slide the hourly chart below shows yesterday’s 122.525 high as the latest smaller-degree corrective high and new short-term risk parameter this market is now minimally required to recoup to defer or threaten a broader peak/reversal count. In lieu of at least such 122.525+ strength further and possibly sharp losses should not surprise straight away.

Today’s losses confirms the trifecta of technical factors typical of major peak/reversal threat environments:

- a confirmed bearish divergence in momentum that, in absolute fact, breaks the uptrend

- historically bullish sentiment and

- an arguably textbook 5-wave Elliott sequence up from 01-Feb’s 99.40 low labeled in the daily log chart above.

The Feb-Jun portion of the bull is so massive that it would be foolish to ignore the possibility of the current break being “just” a 4th-Wave ahead of an eventual 5th-Wave resumption of the bull to another round of new highs. But such a count can ONLY be acted on after a bullish divergence in momentum stems the clear and present downtrend and shows it as a 3-wave and thus corrective affair. And the market has thus far identified specific and objective risk parameters at 122.525 and certainly 127.65 around which to make that judgment. UNTIL such strength is proven however, the gross extent to which the Managed Money community has its neck sticking out on the bull side NOW while the market is selling off is considered fuel for downside vulnerability that could be severe.

These issues considered, shorter-term traders remain advised to maintain a bearish policy with strength above 122.525 minimally required to pare of cover this position. Longer-term players have been advised to neutralize all previous bullish exposure and are next advised to move to a cautious bearish policy at-the-market (118.00) with strength above 122.525 required to pare this exposure and subsequent strength above 127.65 required to negate this call and re-expose the major bull. In lieu of such strength further and potentially severe losses are expected straight away.