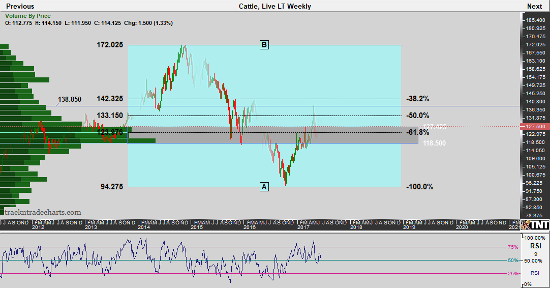

The double top and weekly reversal may signal a move-back to LT value areas in front month fed cattle between 118-127. As of Wednesday, June 14, June futures closed down 300 at 124.50. I mentioned last blog as futures go off the board look for cash and futures to converge in the upper 120’s and I still believe this.

The recent pop offered producers good opportunity for some fall protection at prices that seemed a long way away just 2 months ago.

Other analysts have identified Tuesday’s high and June highs in August live cattle futures as key levels needed to be broken to reverse bearish bias. Key technical factors include a confirmed bearish divergence in momentum, historically bearish sentiment and an arguably completed 5 wave EW sequence. Last blog, I mentioned another EW analysts predicting a potential wave 5 targeting new highs which is what happened. One current projection is a retest of 116-117 area in August LC which would work the lower end of my LT value range mentioned above.

Moving forward there appears to be more room to washout weak longs and test LT support areas. There is still opportunity to consider put protection in the feeders for producers, while bulls might consider different contract options. Bulls should let the market come to you. Supply continues to build.

Live Cattle Weekly Chart

Source TrackN’Trade