With August WTI crude oil futures holding below the 43.00 handle, the market has all but confirmed the bear’s short term control of price action. In last week’s article, I discussed how at that time, a break below the May contract lows would signal for a continued decline to the lower 40.00 handle. With that move well underway, crude has begun its game of “find the support” with bears on the hunt. This week’s EIA Petroleum status report saw yet another draw on crude oil inventories, estimating a 2.5 million barrel decline. This reading was an increase from last week’s draw of 1.7 million barrels, and neither has enticed the market to find a bottom and turn higher.

At this point, it would appear the market has also lost faith in OPEC’s ability to control supplies, as the cartels headlines are barely events anymore. As I have said before, talk is cheap, and while OPEC cuts have been made a reality, it’s clearly not enough of a consensus to empower the bulls. The continued talk and production of US shale has been out pacing the OPEC efforts to cut production, at least in the minds of traders and the market.

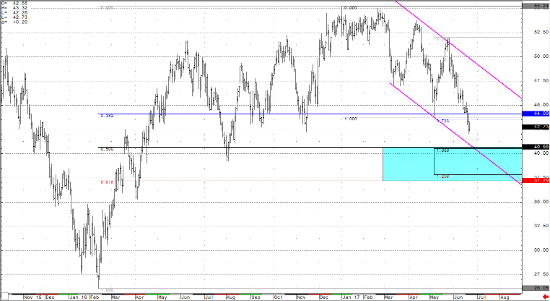

From a technical perspective, breaking below the May 43.76 lows from the continuous contract is massively significant. I discussed last week the same set of technical indicators that are driving the market lower, including two Fibonacci measurements, the lows from July of last year, and the channel the market has been holding the last 4 months. WTI crude futures should find a support level where there is a confluence of Fibonacci support bands (retracements and extensions) between 40.65 and 37.20 (daily continuous chart below). There is also a declining price channel, formed from the trend line against the 53.76 and 52.00 highs, and the trend line against the 47.09 and 43.76 lows. I expect the extension of this trend line support, which crosses the 50% Fibonacci retracement and 100% Fibonacci extension at the 40.65 area, to be tested and support the market in the near to medium term.

Crude Light Continuous Chart