Last week’s Cattle on Feed report continued to show cattle on feed growing, and placements and marketings on the rise. Packers have good margins and have room to discount going into the seasonal demand break. Retailers are adjusting by selling smaller portions to reduce sticker shock.

COT report still showed a near record long after hitting the record the previous week in the non-commercials. Cash has retreated down to 118-120 after trading last week in the lower 120s. I had forecasted futures and cash meeting in the upper 120s going into June expiration in the fed cattle but the seasonals pressured the cash lower than I anticipated.

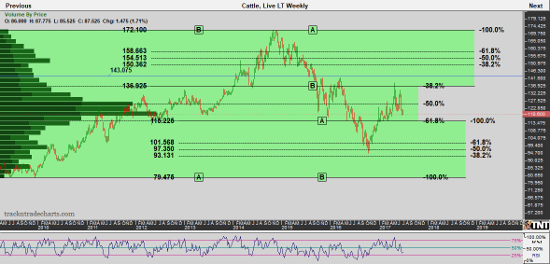

The recent double top on the weekly charts pose a technical challenge for the markets. There is apparent underlying demand that is eating up the high slaughter and feedlots continue to be current. Until the front end supply at the feedlots show signs of building, expect good value support on fed cattle from 106-118 and overhead resistance around 125-127. Feeder cattle futures should see good support at 135 and resistance around 152.

There is still opportunity to protect a test of the Spring ranges with Oct. puts in feeders.

Live Cattle Weekly Chart

Source: Track N’ Trade