Outside markets were mixed overnight with gainers and losers distributed evenly around the globe. The Asian session started with updated readings on Japanese CPI, which were right on expectations, Japanese unemployment which rose to 3.1% and was above expectations of 2.8%, and finally the trade saw Japanese industrial production which fell back by 3.3%. The highlight from the global equity markets came from Chinese PMI that was expected to have a down-tick from May’s 51.2 reading but instead managed to jump to 51.7.

The trade clearly has to be disappointed with the performance of Gold (and all other metals this week), especially in the wake of the sharp declines in the dollar. Surely the metals markets are undermined as a result of the shifting central bank prospects, and it is also likely that the overall improvement of European economic sentiment is chasing weak-handed safe haven longs out of gold positions. Another issue that is undermining gold sentiment is the impending implementation of a tax in India, as that could curtail gold demand and that could also hold back the Indian economy. With gold mining shares in South Africa declining sharply in the Thursday trading session off job cuts and concerns of mines playing out, gold as an investment vehicle has been dealt a short-term blow. An issue that might apply some modest pressure to fold and silver prices this morning is bearish price forecasts from Bank of America. In the end, with a choppy to sideways pattern in gold since June 15 and prices generally carving out a series of lower highs, the bear camp would appear to have an edge. In fact, failure to hold 1239 in August sets the stage for a poor weekly close.

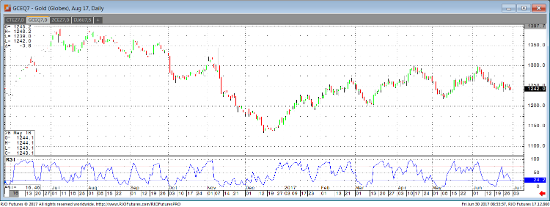

Aug ’17 Gold Daily Chart