Gold futures will continue to keep a data driven mindset that will have a spillover effect on the probability of the speed of another rate hike. Anticipation remains high for 1 more rate hike this year but the possibility of the FED zeroing in on winding down its $4.5 trillion portfolio of mortgage and treasure securities may play more of a significant role in direction. This is in effect is reverse quantitative easing. We should get further insight over the next few weeks when more significant data comes out.

Analysis and Outlook

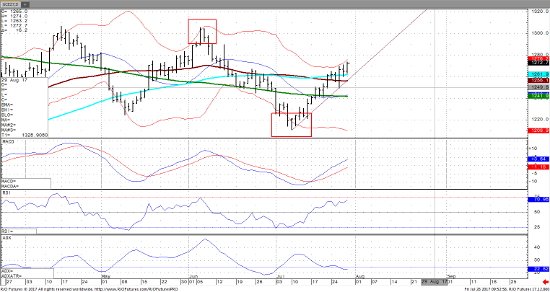

The daily gold chart shows that we are clearly in a bullish trend. A $60 rally so far has been quite impressive, and until we get a close beneath the 200-day moving average at $1242 and the MACD crosses back over we should continue to see a rally. The ADX, which measures strength of the trend, has finally started to weaken indicating that the strength of the trend is starting to run out of steam which is something traders should consider before going long this market. Watch for a situation where gold consolidates at this level and becomes range bound until the next drop-off in the stock market or significantly weaker data out of this week’s economic reports. Pushes through the $1275 could indicate a move to $1300 which is the next level of psychological resistance. Caution should be taken if we see a close below 1250 where a washout could occur into uncharted territories.

Dec ’17 Gold Daily Chart