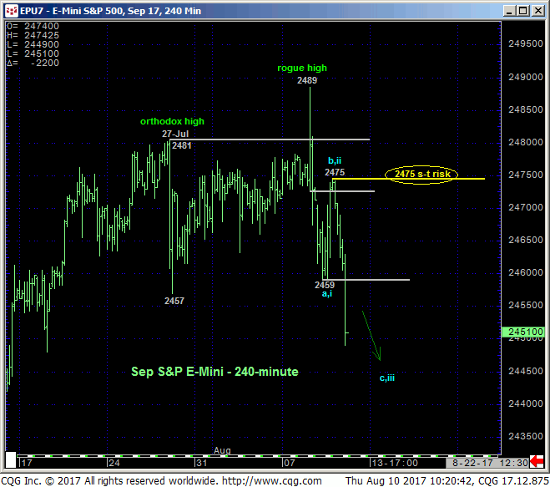

Today’s break below yesterday’s 2459 low reaffirms the developing peak/correction count introduced in yesterday’s Technical Blog with the very important by-product being the market’s definition of yesterday’s 2475 high as the latest smaller-degree corrective high the market must now sustain losses below if something bigger to the bear side is unfolding. In this regard 2475 is considered our new and key short-term risk parameter from which all non-bullish decisions like long-covers and new shorts can be objectively based and managed. The market’s inability to sustain sub-2475 losses will render the sell-off attempt a 3-wave and thus corrective affair that will once again expose the secular bull trend. We will circle around to this short-term but key risk parameter as we discuss larger-degree correction-vs-reversal options below.

There is no question that the past couple days’ failure confirms a bearish divergence in daily momentum shown in both the daily log chart above and daily close-only chart below. But the SCALED of this mo failure only allows us to conclude the end of the uptrend from 29-Jul’s 2402 intra-day low and/or 06-Jul’s 2408 low close. This week’s setback is thus far of a scale INsufficient to conclude anything more than a slightly larger-degree but BULL market correction. Does this mean we can ignore the prospect for a major reversal lower? Absolutely not; only that commensurately larger-degree weakness below these late-Jun/early-Jul larger-degree corrective lows is still required to confirm a momentum failure of a scale sufficient to conclude such.

What we DO know with certainty and specificity is where this market should NOT trade per any broader bearish count: above 2475. In effect then, traders can objectively place a bearish bet for ANY amount of downside- even a major reversal- and it will be considered a valid, objective and favorable risk/reward bet as long as the market remains below 2475.

Acknowledging the market’s downside potential as indeterminable, we have bracketed off a couple areas around which to watch for a countering bullish divergence to stem the clear and present intermediate-term downtrend. IF this setback is a relatively minor correction of “just” Jul-Aug’s portion of the bull, former 2450-area resistance-turned-support and the 38.2% and 50% retraces of the Jul-Aug rally identify the 2450-to-2440-area as one we believe should hold. A bullish divergence in momentum from this area will tilt the directional scales back to the buy side. If, alternatively, a larger-degree correction of an arguable 5-wave Elliott sequence from 13-Apr’s 2327 low close lies ahead, then we’d expect a relapse to the 2420-to-2408-area defined by the 38.2% retrace of Apr-Aug’s 2327 – 2478-rally and 06-Jul’s 2408 (4th-wave correction of lesser-degree) low.

Again, the market’s intermediate-term downside potential is approached as indeterminable and potentially relatively severe until or unless mitigated by a recovery above 2475.

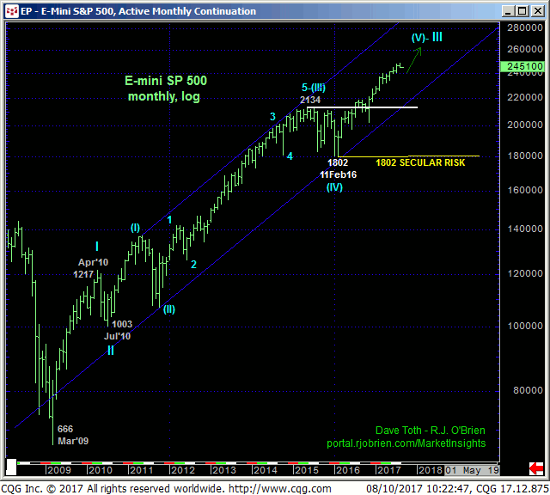

Contributing to at least some interim weakness and correction is the fact that market sentiment levels have been historically high of late and typical of corrections and reversals in the past. And now that the market has, in fact, stemmed the uptrend with a confirmed bearish divergence in momentum, sentiment is an applicable technical tool. This said, on a major monthly scale below this week’s weakness thus far doesn’t register any more than Jun or May’s bull market corrections and BUYING opportunities for longer-term players.

These issues considered, shorter-term traders have been advised to move to a neutral/sideline position and are further advised to consider cautious bearish exposure from the 2455-area OB with a recovery above 2475 negating this call and warranting its cover. Longer-term players are advised to pare bullish exposure to more conservative levels and jettison the position altogether on commensurately larger-degree weakness below 2402. In the meantime we will be watchful for countering bullish divergence in short-term mo from either the 2450-to-2440-range or the 2420-to-2408-range to begin setting the bed for a return to the bull side.