There are many different types of fundamental and technical chart patterns that market technicians focus on when making trading decisions, and multiple ways to interpret them. This is why technical analysis is an art form. The key is to be able to recognize these patterns and implement a trading strategy based on what you believe the charts are telling you are going to happen next. As a trader, it is important that you have a good understanding of the basic patterns before you can develop a strategy to give you a potential edge. When you combine a couple of these different methods, you really unlock the power of technical analysis.

Moving Average Crossover

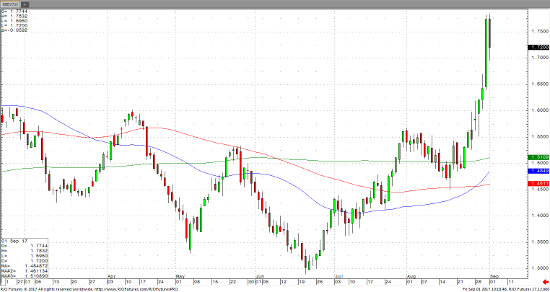

The moving average crossover is a trend identification tool that compares different moving averages. It provides a trading signal when momentum shifts directions. When a shorter moving average crosses a longer one, the trend is seen as up. When a shorter moving average crosses below a longer one, the trend is seen as down.

In the gasoline chart below, we see the blue 50-day moving average cross the red 100-day as the market pushed up on news of Hurricane Harvey. It seems as if the green 200-day moving average would show that historically, the market has been stuck at an equilibrium price of 1.5000. I would refer to this as the Bull/Bear line. I would expect with the storm damaged pipeline carrying 58.8 million gallons of fuel from Texas to the East Coast, we would continue to see futures maintain levels over 1.5000 and ultimately the 50-day and 100-day crossing over the 200-day and moving higher indicating a bull market is solidly in place.

Oct ’17 RBOB Daily Chart