The S&P traded in a $6 range yesterday with volume in the December E-mini well below average. The market continues to shrug off natural disasters after a massive earthquake in Mexico City yesterday, and a category 5 hurricane approaching Puerto Rico with expected landfall later today. The stock market in general continues to make higher highs and higher lows, albeit in a low volume environment, which should be a worrisome sign for bulls going into today’s action. Big economic news will be coming out later this afternoon with an announcement from the Federal Reserve on interest rates. Consensus is no change in rates, but there are whispers that chairwoman Yellen will announce that the fed will start to unwind over 4 trillion off of their balance sheet. If that happens, we could see a sharp rise in short term interest rates and a quick drop in all indices. Traders should watch out below.

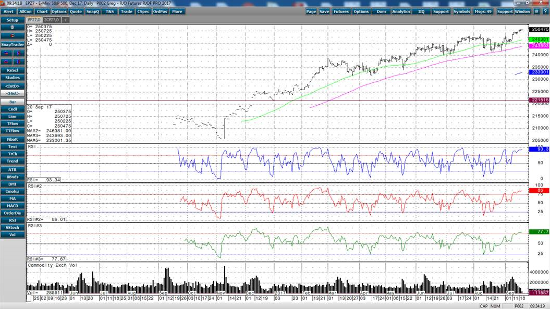

Looking at technical, the S&P E-mini is showing extreme overbought readings, but still no definitive sell signals or reversals. December E-mini is closing in on upside targets of 2510 and 2513.50, while support currently lies at 2494 and 24976.50.

Dec ’17 Emini S&P Daily Chart