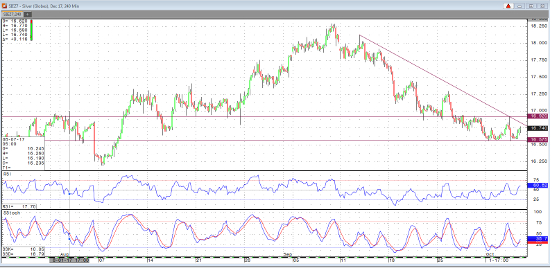

On October 5, December silver is trading at 16.62, up about 1 cent on the day with the daily low of 16.59. The US dollar index once again is putting pressure on the metals. Silver is getting into interesting price levels. Although the overall trend has been down since it made a high of 18.205 on September 8 2017, I’m looking at levels now that I expect a bit of strength. No doubt that the market is approaching oversold levels. The commitment of traders with options report (COT) will be released Friday, and it will be an indication of what the fund’s positions are as of Aug 3, 2017. I suspect that if the dollar correction to the upside ends in near term, silver will likely stabilize and probably head higher.

I expect the COT report to provide some clue as to what the net short fund positions are from previous weeks. Are they getting less short? Or are they getting more aggressive in relative to previous weeks? Also, the chart shows some bottoming price action. Those who would like to get long silver would probably be better served if they come in on strength rather than weakness. That said, a close above 16.90 should provide that near-term lows are possibly in.

Dec ’17 Silver 240 min Chart