The market’s close yesterday above 13-Oct’s 1.418 corrective high and key risk parameter confirms the bullish divergence in momentum discussed in 26-Oct’s Technical Webcast that defines 20-Oct’s 1.385 low as the END of the decline from 18-Sep’s 1.480 high. Combined with that decline from 1.480 to 1.385 tracing out a textbook 5-wave Elliott pattern AND respecting/rejecting 30-Aug’s 1.384 low AND the decline from 18-Sep’s 1.480 high spanning a length exactly 61.8% of Jul-Aug’s preceding 1.534 – 1.384 decline, a confluence of factors is present that warns of a base/reversal-threat that could be major in scope.

The key by-product of this confirmed bullish divergence in mo is the market’s definition of 20-Oct’s 1.385 low as THE specific low, support and new key risk parameter it is now required to fail below to mitigate a base/reversal environment. In lieu of such sub-1.385 weakness we anticipate further and potentially extensive gains in the weeks and perhaps even months ahead.

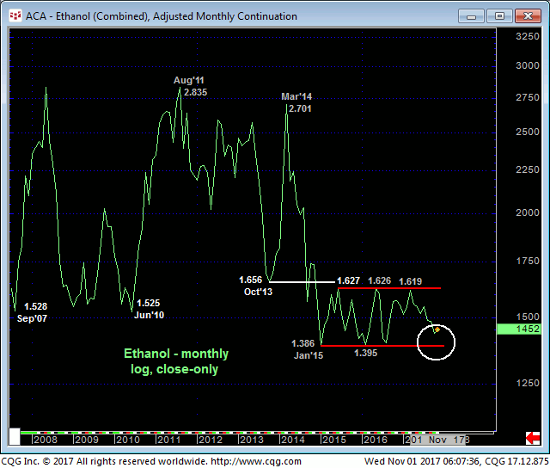

If that weren’t enough, the weekly (above) and monthly (below) log scale close-only charts show the market’s position at the extreme lower recesses of a nearly-three-YEAR-range where we should be suspicious of exactly this type of bullish divergence in momentum to warn of another intra-range rebound that could be significant in scope.

These issues considered, all previously recommended bearish exposure has been advised to be neutralized on a close above 1.418. This will eliminate any pain and suffering should the market take off. Furthermore, setback attempts to the 1.418-to-1.412-range are advised to first be approached as corrective buying opportunities with a failure below 1.385 required to negate this call and reinstate the bear. In lieu of such sub-1.385 weakness we anticipate further and possibly surprising gains in what could be weeks and months ahead.