This week’s continued erosion overnight reaffirms last week’s slide and exposes the intermediate-term trend as down. The important by-product of this resumed slide is the market’s definition of Mon’s 2586 high as the latest smaller-degree corrective high the market now needs to sustain losses below to maintain a more immediate bearish count. Per such we’re considering that 2586 high as our new micro risk parameter from which any interim non-bullish decisions like long-covers and cautious bearish punts can be objectively rebased and managed by short-term scalpers.

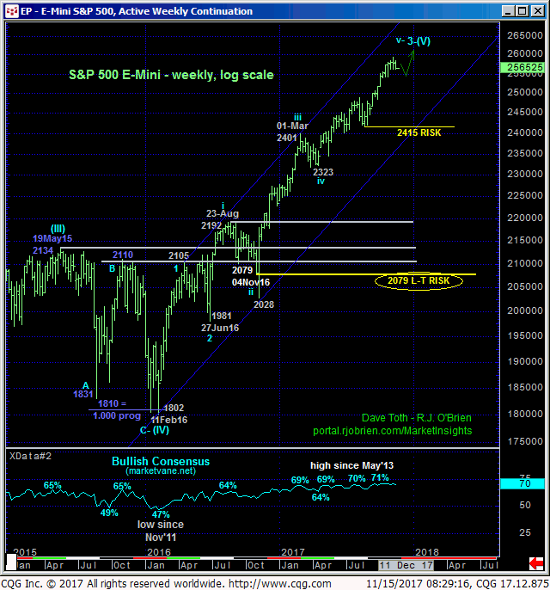

Against the backdrop of the secular bull market however it would be a mistake to conclude the past week’s setback as anything more than another interim corrective hiccup at this point. Indeed, further weakness below 25-Oct’s 2541 corrective low and short-term risk parameter remains minimally required to CONFIRM a bearish divergence in daily momentum (above) needed to break the uptrend from even 21-Aug’s 2415 low, let alone the secular bull.

These issues considered, scalpers remain OK to pursue a cautious bearish policy with a recovery above 2586 required to negate this call and resurrect the secular bull. A bullish policy and exposure remain advised for shorter- and longer-term traders with weakness below at least 2541 still required to pare or neutralize this exposure commensurate with one’s personal risk profile.